QUESTION:

Is it true if an owner defaults than the other owners have to pay their share of the taxes?

ANSWER:

This is a common concern with buyers.

First of all, we need to clarify that each co-owner’s loan is separate, and independent of each other. If there is a default on one co-owner’s loan, the other owners are not affected.

Ok, so what about property taxes?

With property taxes, there is one bill for the whole property (each owner pays their portion which is based on their purchase price), and yes, the owners would have to make sure the whole bill gets paid.

There are quite a few safeguards in place in the TICA to protect all co-owners from another owner defaulting on property taxes

The main safeguard is that it is a foreclose-able item. To help ease the strain of this happening, the property taxes will have to be pro-rated and paid monthly to the HOA. The owners can foreclose on a defaulting owner for non-payment of HOA dues and/or property taxes. The property taxes can also be pro-rated and impounded to the lender, in which case the lender would foreclose on the borrower. Additionally, each owner will deposit 2-months of pro-rated HOA dues and taxes into a savings account specifically for default, at close of escrow. If someone misses a monthly payment, that will trigger the other owners to know to start preparing for a foreclosure. When the bill becomes due, they can pull from the savings account to make sure the bill gets paid. And they will have 6-months to prepare for the next bill, while they are going through the foreclosure.

What kind of risk are we talking about?

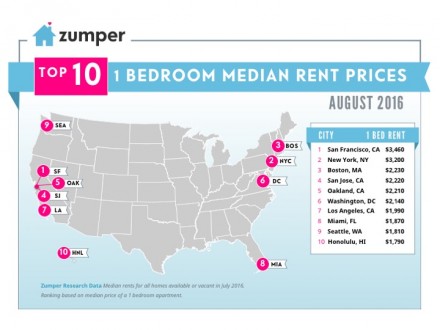

With that said, there has never been a foreclosure for non-payment of property taxes in San Fransisco in over 30 years. It just doesn’t happen. And though we have to talk about this risk, as it is the main difference between owning a condo and owning a TIC, the risk is low.

Why default risk is low

We attribute this to the fact that there are only a handful of lenders who offer TIC loans, and they all have stricter requirements: 700 credit score, minimum 10% down, 6 months reserves seasoned in the bank account on top of the down-payment. This borrower is what many loan officers refer to as a “Grade A” borrower, a financially responsible borrower. Or, the buyer is all cash.

This is who is co-owning with you. It’s not like buying into a condo, where your neighbor could have purchased their unit with a VA/FHA loan, low downpayment, sub-700 credit score.

Even TIC lenders have extremely low foreclosure rates

Both NCB and Sterling have each only had 2 foreclosures on TIC loans in almost 2 decades since offering this loan product.

New for LA, but tested and proven in SF

Venturing into something new always feels riskier. It’s important to know that even though this is a new market for us here in Los Angeles, it has been tested and proven in San Fransisco for over 30 years. TIC communities there are very successful.

You are not alone

Here at The Rental Girl, we have sold over 70 TIC units since 2017, and we have over 200 units in our pipeline for 2020/early 2021. You can view all our past TIC sales and communities on our website:

https://therentalgirl.com/tic-sold

Do you have other TIC questions?

Reach out to liz@therentalgirl.com for any other questions on TIC!