Throughout the pandemic, the speed of home purchases has skyrocketed. Supply is low, and demand is high thanks to some of the lowest mortgage rates since the recession. With the availability of online resources, you would think buyers are more educated than ever. However, quite the opposite is true.

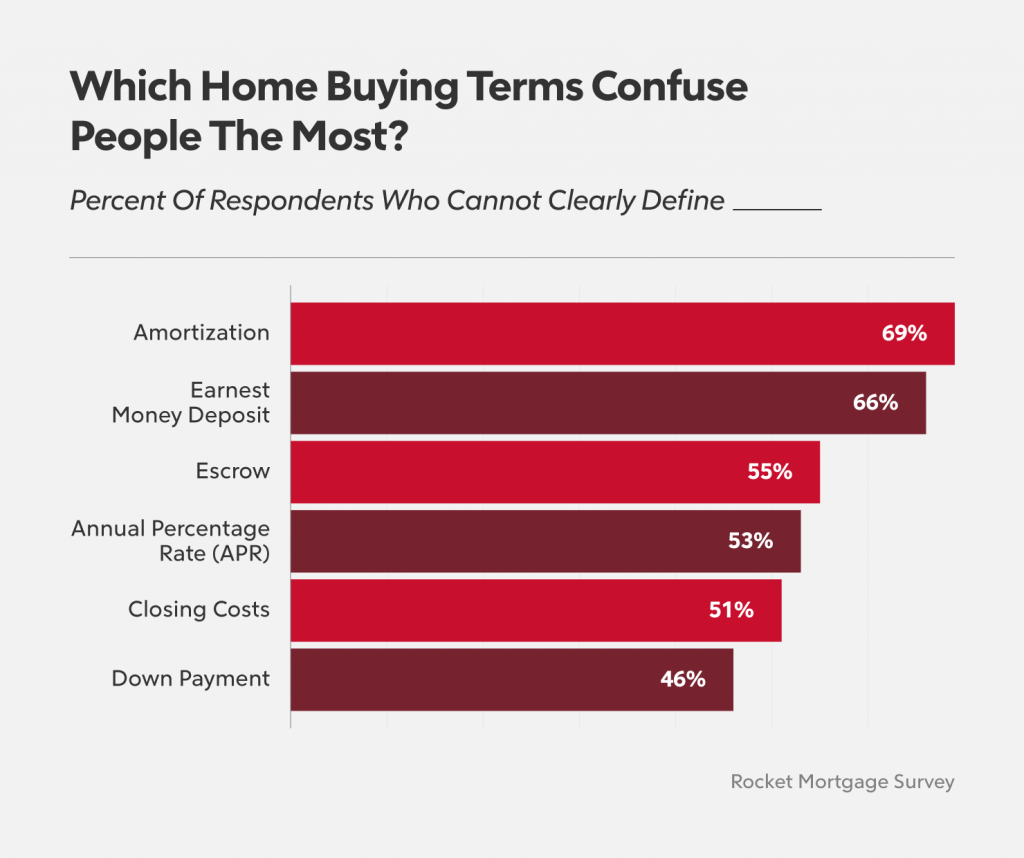

While the older baby boomer generation reported knowing the most home buying terms of any other demographic, a study by Rocket Mortgage reveals that 40% of mortgage terms confuse people. Even more surprising still is that the largest demographic of home buyers are in the millennial age group — yet they’re the people least likely to know any mortgage terms. In fact, only 34% of millennials reported understanding the term “down payment.”

Nearly a quarter of respondents didn’t know the term “amortization,” which may surprise them when they take a look at how their payments have been allocated in years to come. Turns out the women have been doing most of the shopping as well because men are 1.2x more likely to get confused by home buying terms than their female counterparts.

So what’s important to know if you’re considering purchasing property?

Think about how your money will be spent on this purchase. Consider taxes and fees of purchasing a home, and things like property gains tax if you plan on making your unit rental property.

Last, understand how your mortgage payments will be broken down. A large percentage of your monthly payment won’t go to your principal, but interest payments. Oftentimes, if you can swing a few hundred more on your payments each month, you can save tens of thousands on your interest over the course of the mortgage — that is, of course, if your terms indicate additional payment will go towards your principal.