The following article was written by The Rental Girl founder and TIC Team co-lead, Liz McDonald. Liz writes about how The Rental Girl pioneered the Tenants in common (TIC) market in Los Angeles, and why she believes it is so important for the overall economic health of our housing market.

In 2002, I came home from work to find a 60% rent increase on my door. I was 23 years old, living in a studio above a garage in Burbank, California. The notice lit a fire of anger in me. The root of the anger was fear – I lost control of my housing, and that scared me.

When I was in high school, I use to look at the Sunday real estate section in the LA Times. One Sunday morning, my dad saw me looking at beach homes for sale. He told me that if I wanted to buy a home like one of these, I had to start with buying something small. He explained to me that the longer I own property, the more it appreciates. After owning for a while, I could sell for more than I purchased for and then I could buy another home in a better location, or more homes as an investment. As a young adult, this was my first and only education about buying property. Like many other young people, buying and owning property is not something you learn about in school. It’s often times not something parents talk about with their kids. The right to homeownership is so engrained in our culture, it’s often passed off as something that is just “there” and already known – the need to speak about, learn about it, and to understand its benefits is unfortunately overlooked. Those who do not have the benefit of having someone to guide them into homeownership often never look for the possibility or realize it is within reach. And with our current economic conditions, a widening wealth gap, the possibility of homeownership is becoming barely reachable at all.

Back in 2002, I was being forced to move out of my rental and it left me with a bitter hate for my landlord. I decided I would not let this happen to me again – I would try to buy a home. I had that conversation with my dad years back and it stuck with me. I would start small. I was already living in a small space. I figured I would buy a house and rent it out, and live in a converted garage studio.

I searched for months. This was before Zillow and Redfin and my agent had to fax me a list every weekend. I would drive-by over 50 properties each weekend, it was 2002 and a buyer’s market. Even so, I could not afford a home on my own. I ended up buying a building fractionally, as Tenants in common (TIC). I recruited my brothers to buy an apartment building with me. We found a building and we each moved into one of the units, where we still reside today with our families. When we closed escrow, my realtor asked us how we wanted to hold title, and went over our options with us. We held title as tenants-in-common, which protected each of our investments, allowing us to will our 1/3rd share to our heirs.

This event was so impactful for me, that I left my job and got into real estate. I mentored with a broker, a family friend who had his own property management company. I handled his leasing for him, and in 2004 I went off on my own, and founded The Rental Girl.

I had a goal. I wanted to help other renters regain their power over their housing, just like I had done. But I never thought I could tell renters to buy a property fractionally with others, literally like I had done. I always considered myself lucky. Who else would have friends or family ready to buy at the same time? And then finding a property everyone was willing to buy – it seemed impossible. For the 15+ years I’ve been working with renters at The Rental Girl, getting renters into homeownership has been an uphill battle. Since 2004, I have heard the same story over and over:

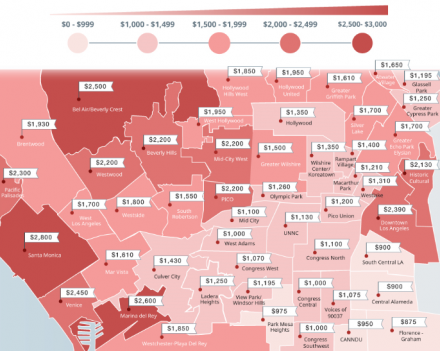

“Housing is too expensive in LA, I’ll never be able to buy.”

But in 2016, things changed. I met Sterling Bank, and Sterling had the key to make fractional homeownership possible for renters much like myself. With a fractional loan being offered in LA, strangers could now buy a property together. Sterling Bank’s fractional loan product could change housing in L.A.

When I met Sterling Bank, I did not realize they had been trying to push this market in LA for over a year, unsuccessfully. They had done multiple workshops and presentations to investors and though many were interested, no one was willing to test the market. My client was one of those investors. And when he presented the concept of TIC ownership to me, I instantly “got it.” I knew exactly what it was, I understood that the fractional loan was what would make a TIC market possible in LA. And I knew I could sell it. This loan product was the missing link to what I needed to fulfill my purpose – helping renters regain their power over their housing.

I also did not realize at the time that I would be a main player in pioneering a TIC market in LA, that The Rental Girl would be at the forefront of this movement. My client realized it, and wanted my help testing the market. At that point he didn’t even know that I owned a TIC, that this was how I got into real estate and why I started The Rental Girl. He just had the foresight that The Rental Girl had an inherent quality, a strong brand presence and reputation essential for encouraging early adopters and over-all market buy-in.

Even over the first year, after selling two TIC buildings, I still did not get the importance of my role. I pushed TIC on every realtor who would listen to me. I created a “TIC Bible” a checklist on how to sell TIC. I thought, if I can do it, they can too. What I didn’t realize is that my checklist was ever evolving. That after selling over 50 units in 2 years, the lessons I was learning with each transaction were contributing to an incredibly fast learning curve, improving my ability to sell and explain TIC, improving my processes, improving the HOA structure, improving my systems and our communities. It wasn’t until I started to see other agents fail, that I realized the importance I have and the value I bring in selling TIC.

Together with my partner Cristina, we have created a TIC Team at The Rental Girl. Through this process, we have become TIC consultants for investors and landlords. We are helping develop future TIC communities. We help the developer with project analysis and execution. We are TIC listing agents selling TIC communities to co-owners, most of whom were previously renting. We have had a high quantity of listings, we’ve made mistakes and are learning from them. Because of this fast learning curve and the constant improvements we are making to our process and to our communities, we now have a policy of only selling TIC listings in communities we have consulted the developer on from the beginning. We will not take over another project if other units have sold and we will not sell a project that has been developed without our oversight and input. We want to make sure we can stand behind the communities we are selling. You can read more about our Gold Standard, here.

We not only take pride in the communities we’ve developed, we take ownership in their success. The success of each community is critical for the overall success of the TIC market in LA. We’re not just trying to sell a unit, we’re selling a market, a new market. We’re selling a concept, a new concept. Each community we sell is depending on us. And that is something we do not take lightly.

After years of helping landlords rent their properties, and renters rent them, why am I now turning my focus on TIC sales? The Rental Girl leasing team is still very much going strong. You can still depend on us as you have since 2004 on finding quality rentals. But I, with the help of my TIC Team, am solely focused on growing the TIC market in Los Angeles. Why? Because our economy needs it, desperately.

Even as a 23 year old, I knew rent control was not a sustainable solution to affordable housing. I recognized it was a bandaid, aiding those in need in the immediate moment. But for long term economical health, more sustainable housing solutions would be needed. Not just one solution, not a one-size-fits-all solution rent control is made out to be, but multiple solutions to encompass all economic backgrounds. And not bandaids to cover up the symptoms of deeper problems, but solutions that attack the roots of the economic malfunctions of our economy, and future-thinking solutions that can begin to change our future for the better.

A problem with our housing situation has been supply and demand. The problem with the supply part is that government funded housing does not work, and there have been little incentives for developers to build affordable and mid-range rentals or homes. Demand keeps increasing, but with no economical incentive for encouraging construction of affordable and mid-level housing, the demand is not being met. If investors aren’t making money, they will invest their money elsewhere. Now, I know what most of you are thinking. It seems to be human nature to loathe other people making money when we aren’t. Knowing that others are making money off our housing just does not sit well for most of us. But the reality is, we have not been able to rely solely on our government for housing. The reality is, we need investors developing housing, and they require a profit.

One potential solution to our housing issues is working with our local government to create opportunities and incentives for developers to develop low-income and mid-income housing. We can continue fighting for rent control, but rent control does little to help the future of renters. We need to also fight for a better future. Rent control is a necessary bandaid. But once in a rent control unit, then what’s next? We need to create more housing, and not just low-income and luxury housing, we must also create mid-income level housing. And we need to create opportunities to get renters out of their rentals, and into homeownership.

Some argue that the downside of TIC sales are that they are removing rent controlled apartments from the rental market. And that renters are being relocated in order for the units to be sold. They will argue that this will add more burdens to our housing crises, and that it is unfair to remove a tenant from their home.

But that is just the point. It’s a lesson I learned when I was 23. We do not have power over our housing when we are renting. We cannot depend on rentals as our permanent housing solution. Renting will always be the only options for some, no matter what the economic status is, as not everyone is always looking to move into a home they will live in forever. Also, not everyone can afford to buy. But we have to stop accepting this reason – that renting is the only option because renters cannot afford to buy. This is a symptom of a systemic economic failure, and this is the change we need to fight for. However, our fight for renters has been singularly focused, with more and more intensity, on preserving and strengthening rent control.

With rent control going on 40 years in Los Angeles, the entitlement to ones rent is just as engrained in our culture as the American Dream of owning once was. We must continue fighting for the right to homeownership, with the same fervor and passion as we are fighting for fixed rent, and affordable rental housing. Why have we stopped? Because we don’t believe it is possible. And if it’s not possible, then we are forced to hold on to what we have – rent controlled units. But this is not a future-thinking solution. This is not a systemic approach to creating a healthy housing economy. We must also continue dreaming up possibilities of homeownership, creating new opportunities to get renters into homeownership.

In the past 2 years, I have been interviewed for media stories 12 times. And each time, the story is the same: a short explanation of what TIC is, who is benefiting from it, and who is not. To sell an apartment building fractionally, to multiple co-owners, the previous occupants are relocated. There is a state law that allows landlords to remove their rental units from the rental market which often has to happen to sell TIC to buyers who plan to owner occupy the unit. The problem with the past press, is that these articles have not gotten to the heart of the issue.

To be told you have to move out of your home, no matter how much the monetary relocation fee is, is not easy. When it happened to me, and I was not poor, elderly or disabled, it was the most angry I have ever been. The heart of the issue is that rent control has given us a false sense of security over our housing. But renting is not safe, and has never been. It is not a viable and permanent solution to housing low-income, elderly, and disabled. Because we have been so vocal and adamant about rent control, local politicians have used it as a red herring, putting rent control at the forefront of affordable housing and diverting much needed attention, resources and energy to developing and creating alternative sustainable solutions for those in our community in need. We cannot continue to allow members of our community to grow to be 90-years old, living on life-support, and to have gotten through life with absolutely no other options, no place else to go other than a rent controlled unit. We need more solutions.

My plea to renters is to stop relying on rent control as the only solution to affordable housing. Rent control is a one-size-fits-all and only solution to affordability and has not helped improve our housing situation, which has been getting worse every year since I have been working as a rental broker. It may be the only safety net our city, government, and community has afforded you, but things have to change. And I am not saying we need to get rid of rent control, as that would have equally devastating results, but we have to stop pushing all our attention on it. We need to divert some energy and resources to future housing solutions that are more sustainable.

I have found TIC ownership to be one such solution, and am fighting for it. But there are many of you out there, and many other solutions to be discovered and explored.

What solutions will you find and fight for?

MORE FROM THE RENTAL GIRL ON TIC OWNERSHIP:

- Read more about TIC ownership HERE

- Download a copy of our TIC Field GuideHERE

- View all our current TIC offerings HERE

- The Rental Girl + TIC + Our Story HERE

- Visit Andy Sirkin’s website for more research on TIC sales HERE

(Andy is the TIC attorney who pioneered TIC sales in the early 80’s in San Francisco. His website has a wealth of info on TIC ownership). - View TRG + TIC in the News, for Press & Media go HERE

- If you are a buyer or investor interested in purchasing or developing a TIC, contact an experienced TIC Realtor® on our team.

Elizabeth McDonald, Broker & TIC Co-Lead

liz@therentalgirl.com

The Rental Girl

323-313-5780 / Cell

BRE Lic #: 01449897

ABOUT THE RENTAL GIRL & HOW WE GOT INVOLVED WITH TENANTS in COMMON (TIC):

The Rental Girl (therentalgirl.com) is a full service Real Estate brokerage specializing in residential leasing and sales. We have been serving renters and landlords since 2004. We work with thousands of Los Angeles renters each year, and many of these renters are qualified to buy, but can’t afford or find a home in a neighborhood they want to live. In 2016, a client of ours introduced us to TIC ownership and we saw immediately how many renters and entry level buyers in LA could benefit from a TIC market here. We met with Sterling Bank, who was working actively to pioneer a TIC market in LA, and other San Francisco vendors. And so began our research on TICs. Since then, we have helped bring many TIC units to the market, and we have many new TIC communities coming soon. With every new TIC building that hits the market, more renters, landlords and realtors are discovering TIC sales and the TIC movement is growing rapidly. We love to share our accumulated knowledge, and support our real estate colleagues, landlords and renters and the TIC community.