TENANTS IN COMMON (TIC) FRACTIONAL LOANS EXPLAINED.

Are you looking at purchasing a TIC? Sterling Bank was one of the first to develop a Tenants in Common (TIC) fractional loan product in the San Francisco Bay Area. And Sterling is the first bank to offer a TIC Fractional loan product here in Los Angeles. Because of Sterling Bank, we now have a TIC market in Los Angeles.

Henry Jeanes, TIC Loan Consultant

Head of TIC Loans, Los Angeles

HJeanes@sterlingbank.com

415-970-9889 – Office

415-990-5620 – Cell NMLS#: 657755

WHY STERLING BANK…

To understand why we have a TIC market in Los Angeles, it is important to understand the history of TIC sales, and why Sterling plays an important role.

WHAT IS TIC…

Tenants in Common, or TIC, is a way to hold title. You can hold title as sole owner, as a corporation, as a trust, or as community property. If two or more people buy a property together, they can either hold title as tenants in common, or as joint tenants. The difference has to do with right of survivorship. What does that mean? Well, let’s say you buy a property with a friend, John, and hold title as joint tenants. If John passes away, you will inherit his 50% share of the property. But, if you hold title as tenants in common, you would not have a right to his share. John would be able to will his share to his heirs. Holding title as tenants in common you are able to will, sell, or gamble your share.

Tenants in common is a way to hold title, giving each co-owner a percentage of interest in the whole property.

HISTORY OF TIC…

Andy Sirkin was a young attorney in San Francisco in the 70’s. He wanted to buy a home but couldn’t afford it. So, he bought a 4-unit building with friends, and held title as tenants in common. They all got on a loan together, and they created a TIC Agreement, or a TICA, as a legal binding document regulating how they would co-own the building together. Andy wrote the TICA to mimic condo ownership. Their arrangement worked out so well, that other people started asking Andy for his agreement. Soon, the concept started spreading and more and more people starting buying properties together using Andy’s TICA to formalize the arrangement.

Tenants in common is a way to hold title, giving each co-owner a percentage of interest in the whole property, and along with a TIC Agreement gives each co-owner exclusive rights to one unit.

HISTORY OF TIC FRACTIONAL LOANS…

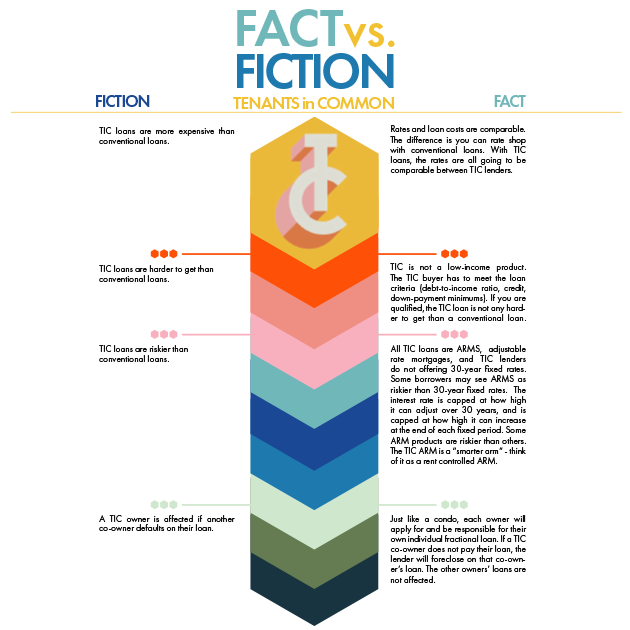

During the first decade, these buyers were all getting on group loans together. The problem with group loans is that each co-owner was financially tied to the other. If one co-owner missed their payment, it affected the group. If one co-owner wanted to sell, the others would need to approve the new owner so they knew who was going to be on the loan with them. These TIC owners began approaching local banks in hopes that a lender would start to offer a TIC fractional loan product. These TIC owners wanted out of the group loan, and wanted individual loans. Finally, in the mid-90’s, a lender agreed, and the first fractional loan product emerged. This first bank tested the market, and it proved to be a successful loan product. In the mid-2000’s other mid-sized banks joined the market, one of them being Sterling Bank. Sterling has increased their presence in San Fransisco ever since. Now with a fractional loan, the co-owners are tied to each other’s mortgages as they were before. If one co-owner defaults, the lender will foreclose on the defaulting owners fractional loan only – fractional loan, fractional foreclosure.

Tenants in common is a way to hold title, giving each co-owner a percentage of interest in the whole property, and along with a TIC Agreement gives each co-owner exclusive rights to one unit, and now each co-owner can get an individual fractional loan on their ownership percentage.

TIC LOANS IN LOS ANGELES…

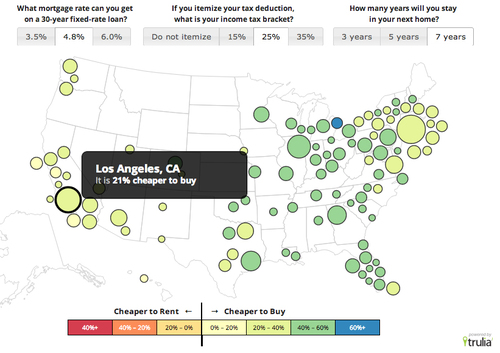

The TIC loan product was doing so well for Sterling Bank in San Francisco, that in 2015 they decided to offer the loan in all of California. Until this point, they were only offering the loan in San Francisco. Because of Sterling Bank, we now have a TIC market in Los Angeles. But, TIC is a consumer conceived idea, and the market is driven by consumers. San Fransisco pioneered and tested the market for us, and we can expect to see it flourish here in Los Angeles as long as there is consumer demand.

FINANCING OPTIONS FOR TENANTS IN COMMON (TIC) PURCHASES…

- Get a loan through a lender who offers TIC fractional loans. There are currently two lenders offering TIC fractional loans in Los Angeles.

- Buy all cash.

- Or, the old way of doing things is to get on a group loan with all owners in the building.

*NOTE that option 3 is pretty much obsolete and all our current listings will not have this option. As you do your research on TIC sales online, you will read about “group loans” and the problems that come with a group mortgage, so it’s worth mentioning. When TIC sales first started back in the 80’s, group loans were the only option for financing. A group loan is when there is one loan for the whole property, and each individual buyer is on this same loan. In the 1990’s, banks started to realize there was a market for TIC fractional loans and started offering them to consumers. Now, individual TIC fractional loans are much more prevalent. There are a handful of lenders in the Bay communities offering fractional loans. One of them, Sterling Bank, has ventured to Los Angeles and is now offering TIC loans here. We are anticipating more lenders in the near future, as TIC sales become more prevalent.

If you want to buy a TIC and need financing, you have to get a loan through a lender who offers TIC fractional loans.

FREQUENTLY ASKED QUESTIONS…

IF YOU ARE ALREADY PRE-APPROVED FOR A LOAN WITH ANOTHER LENDER, CAN YOU USE YOUR LENDER TO PURCHASE A TIC?

Unfortunately you won’t be able to. Here’s why: When you purchase a TIC unit, you are purchasing a fractional interest (with exclusive use to one unit) in multi-unit building. Most lenders, such as Chase, Wells Fargo, Bank of America, etc. want to loan on 100% of the property, and are not willing to loan on a fraction of a property.

WHAT IS TIC FRACTIONAL OWNERSHIP?

If you are purchasing one TIC unit in a 4-plex, you are purchasing 25% interest in that building, with exclusive rights to occupy one specified unit. We call this “fractional ownership” because you are buying a fraction of one building.

WHAT IS TIC FRACTIONAL LOAN?

When you purchase a TIC, you are purchasing a fractional interest in the whole building. Similarly, when you get a loan on a TIC, the lender is lending you money to buy that fraction of the property. The loan collateral is your percentage interest and your exclusive rights area. If you default on your mortgage, the lender will foreclose on you, and your fractional loan, only. The other owners in the building are not affected.

WHAT IF YOUR LENDER CAN OFFER TIC LOAN?

Your lender may tell you that they can help you with a Tenants in Common purchase. If this is the case, go back and clarify to them that this is a Tenants in Common with exclusive rights to occupancy, and requires a fractional loan. Your lender probably is assuming you are purchasing the property with another friend, partner or family member, and wanting to get a group loan with everyone on the loan, and holding title as Tenants in Common. Make sure they understand that the loan will be a fractional loan. Feel free to conference us on the call, or have your lender call us for clarification.

MORE FROM THE RENTAL GIRL ON TIC OWNERSHIP:

- Read more about TIC ownership HERE

- Download a copy of our TIC Field Guide HERE

- View all our current TIC offerings HERE

- The Rental Girl + TIC + Our Story HERE

- Visit Andy Sirkin’s website for more research on TIC sales HERE

(Andy is the TIC attorney who pioneered TIC sales in the early 80’s in San Francisco. His website has a wealth of info on TIC ownership). - View TRG + TIC in the News, for Press & Media go HERE

- If you are a buyer or investor interested in purchasing or developing a TIC, contact an experienced TIC Realtor® on our team.

Elizabeth McDonald, Broker & TIC Co-Lead

liz@therentalgirl.com

The Rental Girl

323-313-5780 / Cell

BRE Lic #: 01449897

ABOUT THE RENTAL GIRL & HOW WE GOT INVOLVED WITH TIC:

The Rental Girl (therentalgirl.com) is a full service Real Estate brokerage specializing in residential leasing and sales. We have been serving renters and landlords since 2004. We work with thousands of Los Angeles renters each year, and many of these renters are qualified to buy, but can’t afford or find a home in a neighborhood they want to live. In 2016, a client of ours introduced us to TIC ownership and we saw immediately how many renters and entry level buyers in LA could benefit from a TIC market here. We met with Sterling Bank, who was working actively to pioneer a TIC market in LA, and other San Francisco vendors. And so began our research on TICs. Since then, we have helped bring many TIC units to the market, and we have many new TIC communities coming soon. With every new TIC building that hits the market, more renters, landlords and realtors are discovering TIC sales and the TIC movement is growing rapidly. We love to share our accumulated knowledge, and support our real estate colleagues, landlords and renters and the TIC community.