Two Rent vs. Buy Scenarios in Los Angeles

By Jennifer Riner, Trulia

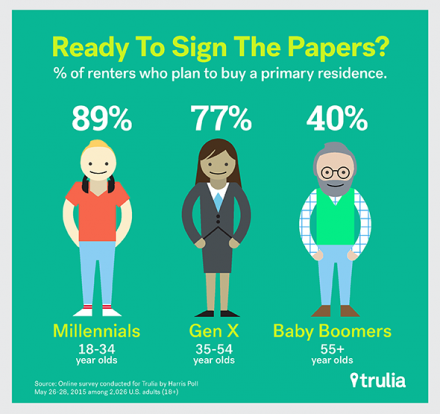

Making the leap from renter to homeowner takes forethought, strategic planning and serious personal reflection. Purchasing a home is by no means a sporadic decision. Fortunately, there are certain tools intended to alleviate common first-time home buyer woes. One is the rent vs. buy calculation, helping provide an overview on which route makes more financial sense.

In most major U.S. metros, favorable interest rates allow for mortgage payments that are often less expensive than the going rent. In the Los Angeles metro, where the median home price is $576,634 and the median rent is $2,700, buying is 29.8 percent cheaper than renting, according to Trulia’s latest rent vs. buy calculations.

That being said, buying isn’t for everyone. Much of the rent vs. buy evaluation boils down variable specifics, such as the target home price, how long you plan to stay, mortgage details, taxes, potential home value growth and personal preference. Plenty of people who have the financial means to buy still opt to rent due to job uncertainties, fewer maintenance-related responsibilities and sheer wanderlust.

Consider the following rent vs. buy scenarios in Los Angeles to see just how different things play out depending on circumstance.

*For brevity, each scenario assumes 20 percent down and preapproval for a 30-year fixed jumbo loan mortgage with a 4.1 percent interest rate.

West Hollywood

Assume a young married couple, Maria and Joe, plan to purchase a home. They own a small marketing agency and currently rent a 2-bedroom, 2-bathroom apartment near their office at 1233 N Orange Grove Avenue for $3,500 per month. Their unit offers rent control, which essentially means that their landlord cannot charge more than the Maximum Allowable Rent set forth by city ordinance. The base can only be increased once per year by proper notice, totaling 75 percent of the Consumer Price Index for the area.

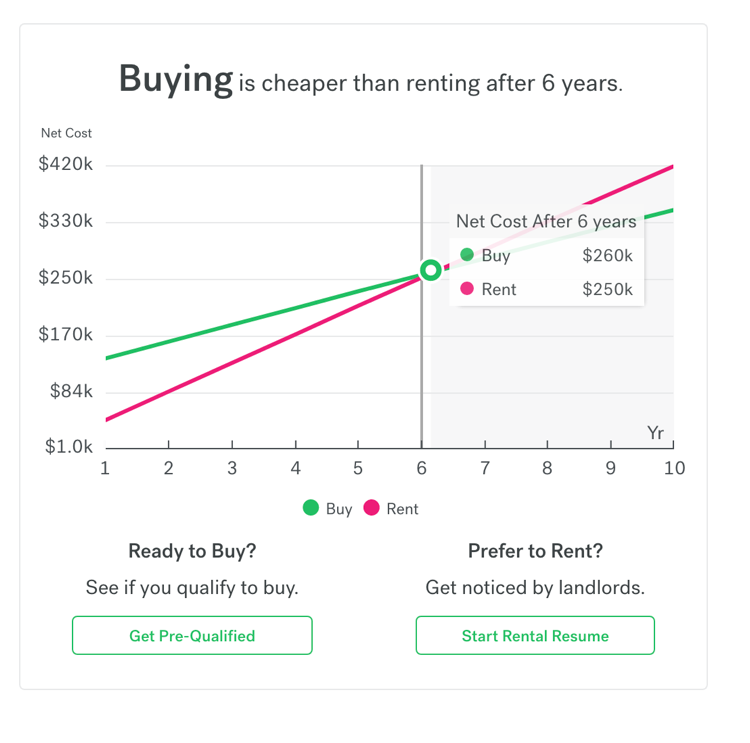

Buying a house in West Hollywood costs roughly $805,000 – the current median sales price in the neighborhood. Maria and Joe begin looking at homes online near this price point and find a 2-bedroom, 2-bathroom condo for sale at $899,000. They realize to put 20 percent down on their purchase and avoid private mortgage insurance (PMI), they would need $179,800 upfront. Combined with a 4.1 percent interest rate, their monthly payments would equal $4,136 per month – not including potential Homeowners Association dues.

For Joe and Maria, buying the home would become cheaper than renting their current apartment after six years. That’s when incidentals like the down payment, appraisal fees and mortgage origination fees spread out and the home appreciates enough to offset those initial costs. Fortunately, their business is nearby, so Joe and Maria are confident in their decision to stay for the next decade or more. As business owners, they usually itemize their taxes, allowing them to take full advantage of the mortgage interest tax deduction benefit come April.

Audience question: Given their situation, would Joe and Maria would be better off buying or renting?

Studio City

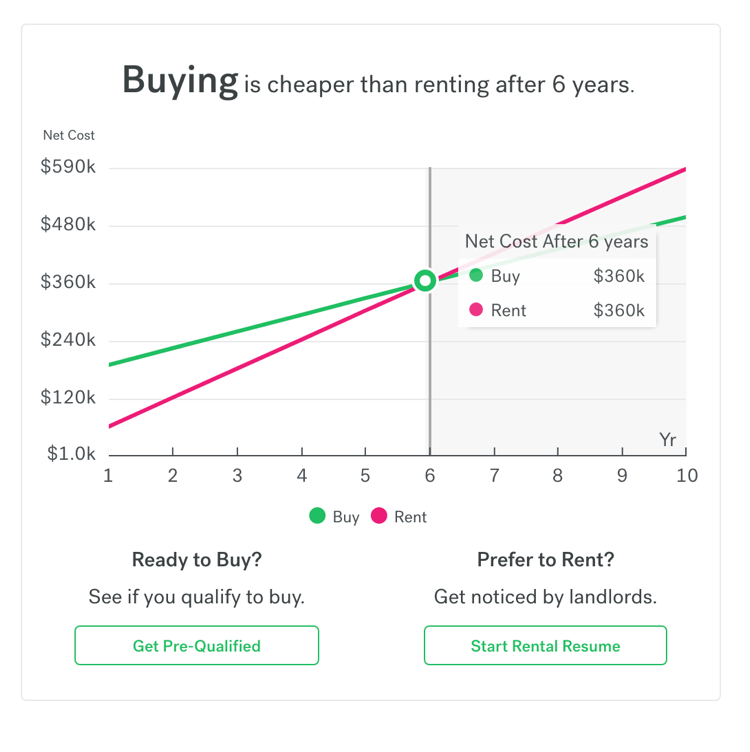

Sue is a single young professional in her 30’s who is renting a house in Studio City. She wants to buy and channel her housing payments toward a more lucrative investment. Sue is currently spending $5,000 per month to rent a 3-bedroom, 2-bathroom mid-century modern abode on Laurel Canyon Boulevard. She sees a home for sale nearby on Ridgemoor Drive that offers the same number of beds and baths as her current layout, albeit greater square footage. The list price is a cool $1.275 million. For reference, the median sales price in Studio City is a steep $1.11 million.

Like any savvy house hunter, Sue uses a mortgage calculator to project her monthly payments and compare those to her current rent. With 20 percent down ($255,000) upfront, Sue would pay her lender $5,892 per month to cover principal and interest, property taxes and insurance. That’s only slightly more than her current rent. All costs considered, buying the house on Rigdemoor Drive would be cheaper than renting on Laurel Canyon in six years.

But, Sue is considering moving closer to family on the East Coast in just two years. When purchasing a home, it’s critical to stay in the home long enough to reduce debt and allow for home price appreciation. In her short stay, Sue would not be able to build enough equity nor would her home realistically increase in value enough to offset her upfront costs.

Sue could instead invest her $255,000 in a savings account with a 3 percent annual interest rate. Her opportunity cost, or the amount she makes investing the down payment, would grow to total $375,500 over a six-year period.

Audience question: Given Sue’s scenario, would she be better off renting and investing her down payment elsewhere?

Buying is usually the better deal – on paper, at least. Paying down a mortgage to build equity in a long-term asset is far more advantageous than paying rent you can’t recuperate down the road. However, there are many reasons for renting to prevail, including future goals or a sluggish real estate market. Ultimately, no two prospective buyers are the same and consulting with a real estate professional prior to such decisions is key.