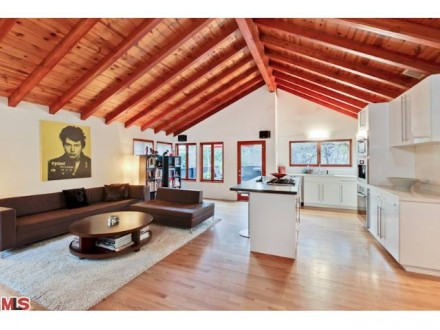

Are you tired of paying rent to someone else? Wouldn’t it be great if someone was paying YOU rent? Whoa, wait a moment. I know what you are thinking. It’s not financially possible, right? Or if it is possible, you don’t want to deal with the headache of being a landlord. Purchasing a small income property (2-4 unit building ) can be just as easy to qualify for as purchasing your first home. And, with an income property you get the added benefit of additional income each month. It’s a hugely fabulous investment, especially in Los Angeles where property values and rents are consistently on the rise. Discuss it more with your agent. Your agent will be able to answer your questions and talk with you about the possibility of being a landlord. Once you start looking for an income property, you can use our spreadsheet to figure out the actual costs of owning an income property.

HOW TO RUN THE NUMBERS

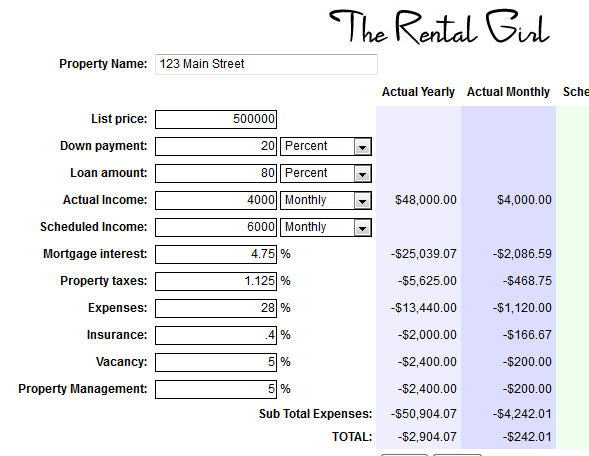

First, with the help of your real estate agent, locate a potential building to buy. Then, go to our Income Calculation Spreadsheet and punch in some numbers. Here’s the data you’ll need to make a sound decision on whether you are ready to take on becoming a landlord:

- Purchase Price: Enter the list price of the investment property you wish to purchase or the amount you are willing to offer.

- Down payment: Be sure to include the total amount of cash you are paying as down payment. You can either enter a percentage or dollar amount.

- Loan amount: The loan amount is the list price minus the down payment.

- Actual Income: Enter the current rent the property is collecting. Specify whether you are entering yearly or monthly income.

- Scheduled Income: If the rents are below market, or the units need upgrading, enter in the rent amount you think the units could get in today’s market. You as an agent can find these yourselves. However, if you’re working with landlord hopefuls, they’ll need your help to determine potential rent amounts. Specify whether you are entering yearly or monthly income.

- Mortgage interest: Enter the loan rate from your pre-approval letter from your loan officer.

- Property taxes: Enter in the percentage amount for your state’s property taxes. (Note: The default percentage in the spreadsheet is for California.)

- Expenses: Leave this percentage at the default rate of 28% or change the percentage if you have a more accurate estimate.

Notes about the spreadsheet:

The amount of maintenance required on an income property varies from property to property. The standard percentage used to estimate maintenance expenses is 28-30% of the yearly income.

Factors that influence maintenance expenses include: age of the building, size of the yard, age of renovations, condition of the major systems like plumbing, electrical and roof.

Insurance, vacancy and property management are fields that should be left with the default amount, or talk with an agent to develop a forecast.

Once you have entered all the fields, the results will appear on the right. These results will give you an idea of your monthly and yearly cash flow – both with current rents and with future predicted rents.

These steps should help you figure out if the specific property you are looking at makes financial sense and ultimately if you’re financially ready to become a landlord.

If you would like more information on home ownership or becoming a landlord, contact us.

—