Rental affordability is the newest housing crisis sweeping the nation, but it’s especially problematic in California. Los Angeles renters pay an average of 48.2 percent of their monthly income on rent – nearly half. The country as a whole pays 30.1 percent to rent and just 15.3 percent on a monthly mortgage. Homeowners in LA pay more than double the U.S. median for their mortgages each month, 40.1 percent of their income. Who can afford that?

Home values bounced back after the recession across most of the country, but rents during the same time skyrocketed. Renters who might be considering buying have a much more challenging time saving a down payment when almost half their income goes to rent each month. However, many millennials, ages 23 to 34, plan to buy homes in 2015. In fact, 12.9 percent of millennials surveyed said they hoped to buy this year, while only 12.1 percent of the overall population planned to buy.

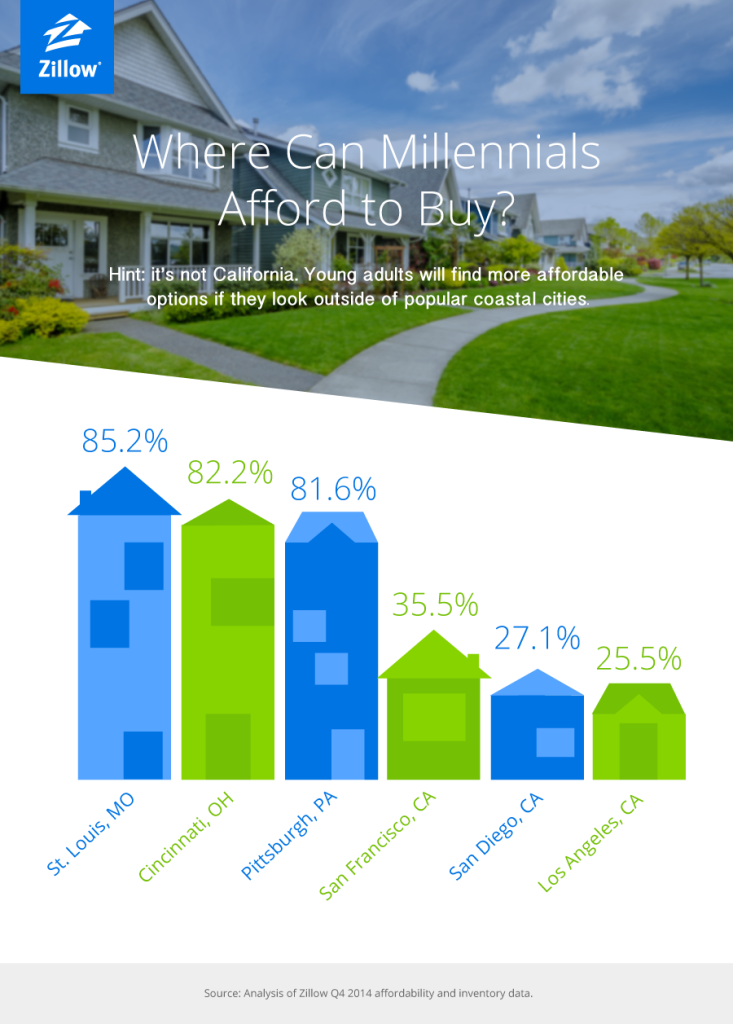

If millennials aim to be the next wave of buyers, Zillow evaluated whether they could afford any of the homes on the market. The study included the for-sale homes on the market at the end of 2014 across 96 different major metros to see if millennials could even compete in the housing market. Economists assumed buyers could spend the industry standard of 30 percent of their income on their mortgages (less than their current rent costs), assuming the median income of young adults in each market, offering just a 5 percent down payment. Surprisingly, 70 percent of for-sale homes are affordable to millennials nationwide.

However, in high-priced markets like California, millennial affordability was much lower. As home values keep rising, the majority of low earners are priced out of buying. LA is the toughest market in California with just 25.5 percent of homes within range for millennial buyers. Nationally, it’s only more affordable than Honolulu with 25.3 percent affordability. Most California markets are predominately out of reach for millennial shoppers. San Diego has just 27 percent affordable homes for millennials while San Francisco, Fresno, Sacramento, San Jose and Modesto all have less than 40 percent of their inventory priced for millennials to buy.

Although inventory demand is high among millennials, they don’t have many options in LA or other coastal towns across the country. Certainly, there is enough inventory for millennials to buy and escape the crisis of rising rents, but those living in the big city will need to consider relocating if they want home shopping options. Otherwise, start house hunting now and remain patient.

Zillow data on Millennials

The Rental Girl invites Guest Bloggers with unique perspectives and helpful housing-related advice to post on our blog. Tali Wee, author of this blog post is a Marketing Content Specialist at Zillow. Zillow is the leading real estate and rental marketplace dedicated to empowering consumers with data, inspiration and knowledge around the place they call home, and connecting them with the best local professionals who can help.

Happy Hunting,

The Rental Girl