The Rental Girl’s Los Angeles Tenancy in Common (TIC) Field Guide: Part I is an overview of what TIC is, the history of TIC, how it works, and why this market exists. It’s a great place to start if you’re curious about tenancy in common sales.

For those who have read our first Field Guide and are still looking for more information, our Field Guide: Part II is a more comprehensive review of TIC. In Part II, we will cover:

- TIC PROS, CONS, AND CONDO COMPARISON

- TIC LOAN

- TIC PROPERTY TAXES

- TIC RENTAL RIGHTS & RESTRICTIONS (if any)

- TIC TITLE PERCENTAGE: What you actually own

- TIC APPRECIATION: Is this a good investment?

- TIC CONVERSION: Can you convert your TIC to condominium?

- TIC HOA: What’s included? Who’s involved and who manages it?

- WHY TIC: Our story

The Rental Girl has sold over 130 TIC units in Los Angeles since 2017. We are bringing over 160 more units to the market in 2021. We are invested in and passionate about TIC, and in seeing this market succeed here in our city, like it has in San Francisco.

Through our experience selling TIC over the past 4 years, and having met thousands of buyers and buyer’s agents, we have had an opportunity to hear and address, over and over again, the same questions, concerns, myths and complaints about TIC.

We hear a lot of complaints that are simply myths. Like, “I heard TIC is hard to sell.” Or, “I heard if one owner defaults on their loan, all owners are in default.” Sometimes, the concern is real, but the real problem is the mindset in which the concern is framed. For example, “I don’t want to have to make decisions with three other people.” (You would have to make decisions with three other people in a 4-unit condo HOA too! Same as TIC). We decided to put all these questions, concerns, complaints and myths into our Field Guide: Part II.

Mindset.

At The Rental Girl we have been working on converting renters into first-time homeowners for 18 years. Before a renter even thinks about buying, the first thing to address is mindset. Many renters do not approach homeownership with the right mindset. For example, we cannot tell you how many renters “do the math.” They calculate how much money they will pay for a home in principle and interest over a 30-year mortgage period. Instead, they should be calculating how much money they would be losing in rent, in lost equity and in appreciation in 30 years. Anyone who has purchased real estate and understands the benefits of home-ownership never “does the math” like this.

Similarly, many buyers and buyer’s agents approach TIC with what we refer to as the “newbie-mindset.” It’s not a wrong mindset – it is normal to have this mindset when you are new to something. As you go through our Field Guide: Part II, you’ll notice that we are often asking you to check your mindset. There are different ways to look at a problem. We will ask you to approach your question or concern from different angles, so that you can make an informed decision.

Apples-to-Apples.

Before we begin to talk about TIC and compare it to other types of homeownership, we have to establish exactly what we are comparing it to. If you want to compare TIC to renting, the differences and the pros and cons are no brainers; TIC makes a whole heck of a lot of sense.

If you want to compare TIC to buying a single-family home, there are a ton of differences.

Most people want to understand the pros and cons of buying a TIC versus a condo. We like to narrow it down even more specifically. For example, if you are looking at a 4-unit TIC, compare it to a 4-unit condo (versus a 40-unit condo). A TIC HOA is going to look and operate much like a similarly sized condo HOA.

Let’s lay out the TIC framework.

Before we get started, we have to make sure we are on the same page. TIC is fractional ownership. You can sell a birdhouse fractionally, a dog house, a bedroom in a single-family home, a garage as TIC. You can sell a fraction of anything. But that is not what we are doing. We are only selling apartment (multi-family) properties fractionally. When you buy TIC, you’re buying a fraction of a multi-family parcel/property, with exclusive usage rights to one entire apartment unit. We are not selling a bedroom in a home. We are not taking a single-family home and turning it into apartments.

With TIC, we take existing multi-family properties, and sell each unit fractionally as tenancy in common.

It is important to point out that in Los Angeles, multi-family apartment properties come in all shapes and sizes. When you hear “apartment building,” you may think of one building, with multiple apartment units under one roof. However, in Los Angeles, multi-family properties can be bungalow courts – where each unit is detached, completely separate from each other. Each unit feels like a single-family home, but they are all on one lot (or parcel), usually sharing one water bill, one sewer line, etc. There can be multiple buildings on one property. These properties may not feel like condos, but when we sell them fractionally as TIC, the HOA will operate a lot like a condo building.

TIC looks like a condo, acts like a condo, operates like a condo. You sell it, buy it and rent it like a condo (see section below about rentals). There is no approval process to rent or sell your unit, just like a condo. There is no board “lording” over you. There is no board approval. There is a technical difference (outlined below) that is not noticeable.

The major noticeable differences between a TIC and a condo will be: 1) the loan, and 2) property taxes, both outlined with detailed explanations below.

What Are The Real Pros and Cons of TIC?

Pros

More affordable

Architecturally more interesting

More land, open space

Smaller, more intimate community

Proven track record, successful communities

Stronger HOA, co-owners vetted financially through the lender process

TIC preserves older buildings

Reasonable and affordable loan options

Cons

Two lenders vs. multiple lenders

One interest rate vs. being able to shop around for best rate

Higher interest rate than the going rate

ARM loans vs. 30-year fixed rate loans

One property tax bill vs. individual tax bills

Rental restrictions after an Ellis Act

Similarities between TIC ownership and condo ownership:

You can sell whenever you want, and you do not need permission to sell

You do not need “board approval” to sell or rent your unit

You do not get to “choose” your neighbor

You have to make group decisions

What happens if the roof leaks? Same as a condo

What happens if the HOA owners disagree? Same as a condo

What happens if an HOA owner does not pay their HOA dues? Same as a condo

You need HOA approval for any work done to the exterior of your unit

You can renovate the interior of your unit without permission

You can rent your unit without permission

Rental restrictions apply in the early years of a condo or TIC community if the property was removed from the rental market via The Ellis Act

City and state rental restrictions apply if the condo or TIC is a rent-controlled property

If the condo or TIC is rent-controlled, the city prohibits short term rentals

Your property appreciates with the market

TIC and condo units are valued the same way

When you rent your unit, you keep the income, same as a condo

When you sell your unit, you keep the proceeds, same as a condo

You can rent and sell a condo or TIC for whatever price you want or can get in an open market (no board approval for list/sale price)

Other owners in the community do not have first right of refusal for other condo or TIC sales

Let’s break down the TIC loan.

The main concerns with TIC are around the loan. So, let’s discuss this in-depth.

If you want to buy a condo, you can go to any bank on any street corner and get a loan. Chase, Wells Fargo, US Bank, etc. If you want to buy a TIC, you have to go to a lender who offers TIC fractional loans (or buy with all-cash).

There are two lenders in LA who offer TIC fractional loans, National Cooperative Bank (NCB) from Ohio, and Sterling Bank from Michigan. If you are reading this, and would like to get more information about TIC loan products, please click here to read our blog post about TIC loans. We do not recommend googling these banks and calling their main line. They are large banks and you will likely get directed to an inexperienced loan officer who is not familiar with the bank’s TIC program in LA. Instead, contact a loan officer at the bank who specifically specializes in the bank’s TIC loan programs.

To understand why you can only get a loan through a TIC lender, you have to understand what TIC is.

What is TIC, technically…

TIC is fractional ownership. With TIC, you are buying 1) a fraction of the whole property, AND 2) exclusive rights and usage to one unit.

Take a 4-unit apartment building as an example – it’s one parcel, zoned as a 4-unit multi-family property. Now consider a…

CONDO SCENARIO:

If a developer purchased a 4-unit apartment building and converted it to condos, he would have to relocate the tenants, renovate the units, file the paperwork and work with the city and state to subdivide the one parcel into four parcels, create a condo map, CC&R’s, and rules and regulations on how the condo HOA will operate, and then sell each apartment unit fractionally as condos.

The condo owner owns 100% of everything within their walls and 25% of the common areas.

TIC SCENARIO:

If a developer purchased this same 4-unit apartment building and sold it as TIC, the process he would go through would be very similar: he would relocate the tenants and renovate the units. He would, however, skip the subdivision process; he does not subdivide the one parcel into four parcels. He does create a survey of the property and a TIC Agreement (which is like the CC&R’s and rules and regulations of a condo – it outlines the exclusive use areas and how the TIC HOA will operate), and then he sells each apartment unit fractionally as TIC.

The TIC owner owns 25% of the entire parcel, and has exclusive rights and usage to one unit.

If you go to a conventional lender (like Chase or Wells Fargo, for example), and ask for a loan on a TIC building, they may say “sure, we can loan on that TIC property.” They assume you want a loan for the whole parcel, the fourplex. But you need a fractional loan on 25% of the fourplex.

The two lenders who offer TIC loans in Los Angeles have figured out how to loan on a fraction of the parcel, with the collateral being your exclusive rights area. If one TIC owner defaults on his loan, the bank does a fractional foreclosure on that one fractional loan, not on all the owners of the TIC. In this way, a TIC loan default acts similarly to a condo loan default. The lender would take possession after the foreclosure, and sell the 25% fractional ownership and exclusive rights and usage to a new buyer.

If a TIC owner defaults on his mortgage, are you liable? No. The TIC lender does a fractional foreclosure – the lender forecloses on the defaulting owner, and it does not affect the other TIC owners’ loans.

History of the “Fractional TIC loan.”

Why are there only two lenders? You may think that because there are only two lenders, there must be something wrong with this loan. There is actually nothing wrong with this loan. The loan is a low risk, high reward loan for TIC lenders. To understand why we only have two lenders in LA, it is helpful to understand the history of TIC lending.

First, there was the “Group loan.”

The TIC market started in San Francisco in early 1980s. From the 1980s through the 1990s, there were no TIC fractional lenders. All TIC owners had to be on one loan together – this is referred to as the “group loan.” Until Andy Sirkin came along.

Who is Andy Sirkin? Andy Sirkin is the TIC attorney who pioneered the TIC market in San Francisco in the early 1980s. He has written over 3000 TIC Agreements (TICA) in his career, owned multiple TICs in the Bay Area over the years, and has been involved with multiple TIC HOAs. He has also been intimately involved with the creation of every single TIC loan – working with each bank’s legal council on the creation of their TIC loan product and guidelines. Any time a lender has requested a change or addition to the TICA, he has added it in and never removed it. He has perfected his TICA and he is the main reason TIC communities have a successful tract record. He has a wealth of information about TIC ownership on his blog. We exclusively use Andy Sirkin and his office for the preparation of all our TIC communities and TICAs.

Group loans were risky.

Group loans sound scary to us – if one person in a group loan did not pay their mortgage, everyone would have been in default! For that reason, the TIC Agreement in the ’80s and ’90s had language in it requiring that all incoming buyers be vetted by the other TIC owners in the group. They would want to know who was going to be on this loan with them. As you can imagine, TIC was more difficult to sell back then, and had higher risks because you could be affected by your neighbor’s loan default.

The advent of the fractional TIC loan.

That all changed in the early ’90s. Andy Sirkin, along with another TIC owner, managed to get a meeting with a lending official locally at Circle Bank. They presented a “fractional loan” idea to the bank, and the bank agreed to offer it. Andy worked with the bank’s legal council on creating the guidelines for this first TIC fractional loan product. A few years later, another bank joined the market, and then another, and another. Now, there are a handful of lenders in the Bay Area offering TIC fractional loans. Most of them are local to the Bay Area and are limited to financing in their geographical area.

The two national banks, and also the two leading TIC lenders in the Bay Area, Sterling Bank (Michigan) and National Cooperative Bank (NCB, Ohio) have both come to LA to offer their TIC loan products here. Neither bank “wholesales” their TIC loan, meaning you have to go through their bank’s loan officers to get a TIC loan. Your mortgage broker will not be able to help you get a Sterling or NCB TIC loan.

The TIC market grew!

Around the early 2000s, the TIC market exploded in San Francisco. Many existing TIC communities refinanced their group loans into fractional loans. New TIC communities rapidly emerged, and new buyers were more open to the TIC concept now that they could get independent financing. Plus, liberated from the group loan, TICAs were amended to exclude the language requiring “permission to sell.”

No, thanks. Group loans still exist, but not at the properties we sell.

TIC has been sold for almost 4 decades, so there is quite a bit of information online. Because group loans were so prevalent for the first two decades, most of the “cons” you will read about TIC have to do with group loans. For example, the common concern that it is more difficult to sell TIC, and that all owners would be in default if one owner defaults on his loan, are true concerns with group loans, but not relevant with fractional loans. These concerns were more prevalent in the ’80s and ’90s, but they would still apply today in TIC communities with group loans. Though it’s hard for us to understand how the benefits outweigh the risks of group loans, there are TIC communities in the Bay Area who are still on group loans, and they love them! None of the TIC communities sold by The Rental Girl are on group loans, and so these concerns do not apply to us.

TIC Myth: Loan Default & Difficulty.

For the reasons explained above, this is the number one myth of TICs. Yes, TIC is more difficult to sell when you are in a group loan. Incoming buyers have to be vetted by the other TIC co-owners. TIC is also more risky as you would be in default if another owner in a group loan does not pay their mortgage. Not so with fractional loans. The Rental Girl is not selling TIC with group loans, and therefore these concerns should not apply to you.

MYTH: If one TIC owner defaults on his loan, all the owners of the TIC are affected, or in default. This is not true with fractional loans.

TIC MYTH: Because there are only two lenders in LA offering TIC loans there must be something wrong with the TIC loan, otherwise more banks would be offering it.

If you want to buy a condo, you can go to any bank and get a loan. With TIC, you’re limited to two lenders (currently). And not everyone qualifies for these loans (minimum 10% down payment). This is the main downside of TIC.

MYTH: TIC buyers are limited on financing because banks don’t want to carry this loan due to the loan being “bad” – this is not true.

The TIC loan is a strong loan product with a successful track record. In twenty years, Sterling Bank has only had one foreclosure, and NCB has only had two. TIC loans have an extremely low foreclosure rate. Sterling and NCB have been offering this TIC loan in San Francisco for almost 20 years. They tested, tried and proved this loan works, and now they are expanding it. In 2016, Sterling Bank was looking to expand their residential lending. They had enough data on the TIC loan to understand it was a high performing loan and worth expanding. They decided to offer their TIC loan product all over California. They came to Los Angeles to push the loan here, knowing this was the next logical city for a TIC market.

Fannie/Freddie Guidelines & why more banks aren’t offering TIC loans:

The TIC loan is a portfolio loan product because TIC loans do not meet Fannie/Freddie guidelines.

Why do Fannie & Freddie have anything to do with this? Conventional lenders make money by giving buyers like yourself loans, and then “packaging” these loans and selling them to a secondary market, such as Fannie Mae and Freddie Mac. Fannie Mae and Freddie Mac will only buy loans which meet their guidelines. There are other secondary markets, but they all mostly follow Fannie/Freddie guidelines.

TIC guidelines actually meet Fannie/Freddie guidelines to a “T”, and TIC lenders are even more stringent with their requirements to qualify. The only reason TIC loans do not qualify is due to the fact that Fannie/Freddie guidelines do not allow for “fractional” loans.

Packaging loans and selling them as a package to a secondary market is how larger institutional banks make money, it’s their normal mode of operation and how they have been doing business forever. They have a successful business model, and do not need to introduce new models to their existing structure. But small lenders have a need to be competitive, and often seek out opportunities to give their company an edge. There are portfolio lenders out there who offer loans that do not meet Fannie/Freddie qualifications. These are the lending institutions that we will be looking to in the future to offer TIC loan products, as this market expands.

Currently, TIC is not on these lender’s radar. They do not know about this market, it is too young. It is true that the market started in the ’80s, but this loan product did not emerge until the 2000s. The lenders who have been offering this loan product since then (Sterling and NCB) hold the data on this loan product, but this data is not being widely marketed to banks nationally. . . yet.

We expect more banks to enter the TIC market as TIC sales increase in Los Angeles.

Interest rates and “ARM” loans.

Currently, the TIC loan interest rates are 3.5%.

After reading that, 80% of you will respond “What!? So high!” And 20% of you will respond “Wow! So low!” (See my note above about mindset!)

If you have been in the real estate business for awhile, 3.5% is extremely low. But it is higher than the going rate (currently 2.8%).

The other difference between a conventional loan and a TIC loan is that TIC loans are all adjustable-rate mortgages (ARM’s). You cannot lock your interest rate in for 30 years.

Let’s discuss mindset. If you are approved for a conventional loan at 2.8% interest, and then set your heart on a TIC listing only to find out you have to pay 3.5% interest, your initial reaction will probably be disappointment. I even see many buyers respond with – “it’s not right!” Some buyers will hear there is a “higher” interest rate and turn around and walk right out the door. They say, “I would be stupid to pay 3.5% when I am quoted 2.8% for a conventional loan!”

We agree. We always tell these buyers – “if you can afford the condo across the street, for the same price, in the same condition, you would be stupid to buy a TIC at a higher interest rate. If you have the luxury to buy something equal in the neighborhood, go ahead and walk out the door and do that.”

The rest of you who do not have the luxury of finding a home you can afford in the neighborhood you want to live in, in a decent condition you can move right in to, come back inside and let’s walk through this ARM and higher interest rate, and see if it makes sense for you.

Angelino’s are buying TIC because they are priced out of the real estate market. They are submitting offers on multiple listings, and getting outbid over and over again. They get to the point where their only option is to go back to renting, or look further outside of their preferred neighborhoods. At that point, TIC options are very attractive.

When you buy a home, you aren’t just buying a roof over your head, you are making an investment in your future. When determining if a purchase is a good investment or not, there are different factors to consider. Interest rate is just one of those factors. But a huge factor is the purchase price. Purchase price and interest rate together ultimately determine affordability. Location is another key factor – which location is going to appreciate faster? Finally, the condition of the home is an important factor – are you going to have to put $25,000 or $50,000 into your investment to bring it up to livable standards? Or, can you move right in?

TIC communities are often in fast-appreciating neighborhoods. They are most often in move-in condition, and do not require extra capital for immediate improvements. TIC listings are often 10-20% less than comparable condos and homes. Because you are limited on your financing, limited to an ARM loan, and limited to a higher interest rate than the going rate, TIC’s often sell 10-20% less than comparable condos. TIC appreciates with the market, and often faster than comparable condos (see below for the stats).

ARM loan explained.

All TIC lenders offer ARM loans, and most of them have the same ARM options. They are all amortized over 30 years, like a conventional loan – you can pay off the loan in 30 years. There are no balloon payments or pre-payment fees. We have found the 5/5 ARM to be the most popular ARM for TIC buyers.

The 5/5 ARM fixes your initial rate of 3.5% for 5 years. So, for years 1-5, you are paying 3.5% interest rate. On year 6, it can adjust. If it adjusts, whatever it adjusts to, that amount would be fixed for another 5 years. And so on, for 30 years.

The scary thing about an adjustable-rate mortgage is the unknown: what is my rate going to adjust to, when, and how often?

The TIC ARM loans, however, have predictability. The adjustments are capped at how high they can go over the life of the loan – 5% max increase in 30 years. If the loan starts a 3.5% interest rate, the max interest you will pay in 30 years will be 5% more than that, 8.5%. The adjustments can happen at the end of the initial fixed term period (on year 6), and then every term period after that (every 5 years, for the 5/5 ARM). There are also term caps – the loan can only increase 2% max every 5 years. The term adjustment is tied to CMT (Treasury Constant Maturity) – the bank is not going to increase the interest to the max just because they feel like it. The interest adjustments are tied to the economy.

To summarize, for the 5/5 ARM, you will be paying 3.5% interest years 1-5. The max your interest will increase on year 6 is 5.5%. If it adjusts, it will be fixed for another 5 years (and so on, every 5 years for 30 years).

The max it will increase on year 11 is 7.5%.

And the max it will increase on year 16 is 8.5%, because that is the lifetime cap.

The rates, historically, have not increased to the max every 5 years.

Let’s do the math…

I recently did the math comparing TIC mortgage to the equivalent in rent. This was an “aha” moment for me, when I realized the TIC ARM loan adjustments were within reason, within affordability, and the ARM loan was not a “bad” option.

Take a $445,500 mortgage as an example.

Your mortgage payment at 3.5% would be about $2,000 a month.

Now, compare that to $2,000 a month in rent.

In the city of Los Angeles, landlords are restricted to increasing rent 4% a year in rent-controlled units. The city of Los Angeles has enacted rent control as a protection for renters. The city has decided that 4% is a reasonable amount to allow landlords to increase rent to cover their costs and increase their investment value, and at the same time protect tenants from increasing rents to unaffordable levels.

If you increase $2,000/month in rent 4% each year, on year 7 you will get to the same amount your mortgage will be on year 6 of an ARM loan, but you will have paid significantly more, and have no appreciation or equity.

RENT SCENARIO

YEAR 1 $2,000

YEAR 2 $2,080

YEAR 3 $2,163.20

YEAR 4 $2,249.73

YEAR 5 $2,339.72

YEAR 6 $2,433.31

TOTAL PAID IN 5 YEARS: $131,102

+Equity: $0

+Appreciation: $0

TIC MORTGAGE SCENARIO

YEAR 1-5 $2,000

YEAR 6 $2,555.00

TOTAL PAID IN 5 YEARS: $120,000

+Equity: $46,000 (plus your initial downpayment)

+Appreciation: $138,458*

*Based on the average historic appreciation rate in Los Angeles, 7%

When I did this math, I realized that the ARM adjustments were within reason. The increases would be within affordability. Of course no one wants to pay more, and if you can lock in a low rate for 30 years, then do it! But, if TIC is an opportunity for you to get your foot in the door in Los Angeles real estate, then the ARM is not a bad option.

TIC MYTH: The reason interest rates are higher and TIC lenders only offer ARM loans is because TIC lenders are greedy!

I find that TIC buyers initially have a hard time understanding WHY they only have ARM loans to choose from. Why is the bank doing this to them!? Why can’t the TIC lenders be like everyone else, and offer 30-year fixed rates? They assume its lender greed, or the lender is trying to monopolize the market.

Why TIC lenders are only offering ARM loans at slightly higher interest rates?

The reason any lender offers a loan is to make money. If a loan isn’t going to make the lender money, they would not offer it. The majority of American’s have an opportunity to buy real estate, because lenders are offering financing. As property values increase, it becomes increasingly more difficult to qualify for a loan. Remember: TIC is 10-20% less expensive than a comparable home or condo, so TIC actually offers a more affordable option for homeowners. But, we need lenders offering loans on TIC to make TIC a possibility. And lenders will not offer TIC loans unless the loan is profitable.

As I mentioned above, there is no secondary market for a TIC fractional loan product. And most lenders make money by packaging their loans and selling them to a secondary market.

Therefore, TIC lenders are all portfolio lenders who keep the loan in their portfolio, but who cannot make money by selling their loans to a secondary market. Because the lender cannot sell the loan, they want to make sure they will make money on the loan, and they want to minimize their risk of foreclosure. When loans are amortized over 30 years, lenders make more money in beginning years of the life of the loan. As the loan matures, the lender makes less money. Portfolio loan products have higher interest rates, and stricter guidelines. When the loan is an adjustable-rate mortgage, the bank can increase the interest over the life of 30 years to help increase their profits. This makes the loan more attractive to the bank, and this is why they are offering the TIC loan product.

If you have the mindset that you have great credit and a good downpayment you have worked hard for, are qualified for a 30-year fixed-rate and a historically low interest rate, and therefore you are entitled to that, you are going to have a difficult time looking at TIC loans as an opportunity.

Alternatively, if you have great credit and a good downpayment you have worked hard for, are qualified for a 30-year fixed rate and a historically low interest rate, but you are priced out of the real estate market and you simply cannot secure a home within your price range, you are going to look at TIC with gratitude, and as an opportunity.

One bank had to pioneer the market in LA

Lenders prefer to have more competition. No lender wants to be the only bank offering one unique loan product. The more lenders offering a TIC loan product, the less risky the loan is for the lender. I outlined the history of the TIC loan product above to give context to this loan product. The TIC market began in the early 1980s, but the fractional loan did not emerge until early 2000s. This loan is relatively new. The lenders who offer TIC fractional loans are pioneers. They took the risk to test, try and prove these loans work. We needed these lending pioneers to get the market going. Most lenders are not going to take this risk. We are very grateful these pioneers took the risk and created the data we have now to prove that TIC fractional loans are low risk and high reward.

Now we are ready for more lenders.

The TIC market is taking off faster than anyone expected in Los Angeles. Sterling Bank is now originating as many TIC loans in Los Angeles as they are in San Fransisco. The LA market is overwhelming the two TIC lenders, and they are doing their best to keep up with the demand. We’re ready for a third lender to help keep up with the demand here.

Why institutional banks will never offer TIC fractional loans.

The next TIC lender will likely be a local bank or portfolio lender. Institutional lenders such as Chase, Wells Fargo, US Bank, or other large banks, will not consider TIC loans because they are well-oiled machines cranking out conventional loans, and they are not looking to change their business model. Smaller local banks, who struggle to compete with larger banks, are open to offering non-qualifying mortgages to stay competitive. As long as TIC loans are low risk (stricter qualifying guidelines) and profitable portfolio products (adjustable rates with even just slightly higher interest rates), there is a good chance more local and/or portfolio lenders will enter the TIC market.

There is only one property tax bill? There must be extra risk with that!

Before we discuss the risk with property taxes, it is important to understand how property taxes work in TIC communities.

If an apartment building is converted into condos, the property which started off as one multi-family/income property, or one parcel (one APN), is then subdivided into multiple parcels, with multiple APN’s. Each condo owner is the sole owner of their parcel (100% of everything within their walls). The tax assessor sends one property tax bill for each parcel. So condo owners each get their own tax bill.

With TIC, the parcel is not subdivided, so there is only one property tax bill sent for the whole property. The tax assessor does not know a TIC Agreement exists, they only know that the property is one parcel, and therefore has one value.

When the TIC HOA receives the tax bill, the TIC co-owners would then have to turn to their governing bylaws (the TIC Agreement) to figure out how to calculate each co-owners portion. Per the TICA, each co-owner is responsible to pay their share of taxes, which is the tax rate times their purchase price. In this way, each TIC owner is paying the exact same amount in taxes as they would be if they bought a condo. If a co-owner sells their TIC in the future for a higher amount, the tax assessor will do a fractional re-assessment of the property. She takes the purchase price of the most recent fractional sale and adds that to the original purchase prices of the fractional owners who have not sold. In this way, property taxes would not increase for the co-owners who remain. The incoming TIC owner pays the increase, as they are paying the tax rate times their purchase price.

Let me break this down for you. Let’s take a 4-unit TIC as an example:

In the year 2020….

Unit 1 sells for $500,000

Unit 2 sells for $500,000

Unit 3 sells for $500,000

Unit 4 sells for $500,000

The total sales is $2,000,000.

The total assessed value of the property will be $2,000,000

The tax assessor will send a bill for approximately 1.25% of $2,000,000.

Each owner is responsible for 1.25% of their purchase price, $500,000.

Now, 10 years down the line, unit 4 co-owner decides to sell his TIC. He sells it to a buyer for $1,000,000.

The tax assessor will do a fractional reassessment on unit 4’s fractional interest. The new assessment value is as follows:

In the year 2030, unit 4 sells for $1,000,000….

Unit 1 assessment is still $500,000

Unit 2 assessment is still $500,000

Unit 3 assessment is still $500,000

Unit 4 new assessment is $1,000,000

The total assessed value is now $2,500,000

The tax assessor will send one bill for approximately 1.25% of $2,500,000.

Each co-owner is responsible for 1.25% of their purchase price: $500,000 for co-owner of unit 1, 2 and 3 and $1,000,000 for co-owner of unit 4.

In this way, the amount of property taxes a co-owner pays is the same as a condo. There are logistical differences. The TIC group gets one bill vs. each co-owner getting their own bill. So where does that bill get mailed? Who owes what? And who makes sure the bill gets paid? This is why we set up all our TIC HOAs with a finance manager who helps collect the HOA dues, pays the bills, and helps with the property tax breakdown and payment.

There is also a liability issue. Now you’re thinking, “Aha! I knew it!” You’re probably feeling this is the information you were looking and waiting for, you knew there had to be a “catch” with TIC, and this must be it! Right!?

If one person does not pay their share of taxes, the whole group is in default. The tax assessor does not care if one person paid their taxes. The assessor wants the whole bill to get paid. The assessor does not know that there is a TIC Agreement that states each owner is responsible for their share of taxes. The tax assessor does not care. If the bill is not paid, or only partially paid, the entire group is in default.

The TIC Agreement takes this liability quite seriously. And there are multiple safeguards in place in the TICA to protect all co-owners from another owner defaulting on property taxes.

The main safeguard is that it is a foreclosable item. If a co-owner does not pay their share of taxes, the other owners can foreclose on the defaulting co-owner.

Next, the TICA requires that the property taxes be pro-rated and paid monthly to the HOA. Instead of waiting for the big bill to arrive at the end of the year, if someone misses one monthly pro-rated payment, the co-owners can begin the foreclosure process right away.

Pro-rating property taxes and paying them monthly is a standard practice in real estate. Most lenders impound property taxes and insurance, and add these costs to the monthly mortgage payments. In TIC, technically property taxes can also be pro-rated and impounded monthly with mortgage payments. However, currently both NCB and Sterling are not offering impound services.

Lastly, each co-owner will deposit 2-months of pro-rated taxes, and two month’s HOA dues into the HOA’s default savings account, at close of escrow. This account is specifically for default, and is not an impound account to pay the bill at the end of the year. This account will hopefully never be touched. These funds will just sit there. If someone defaults on their HOA dues or property taxes, the other owners can pull from this account to pay the bill. When you go to sell your TIC, the incoming buyer will reimburse you for these funds.

If a co-owner misses a monthly payment, that will trigger the other owners to know to start preparing for a foreclosure. They will pull from the default account to pay the bill, while they are going through the foreclosure.

WHAT KIND OF RISK ARE WE TALKING ABOUT?

For those of you who will go on to purchase TIC, here is the “aha!” moment you were waiting for:

With these safeguards in place, there has not been a foreclosure for non-payment of property taxes in San Francisco or Los Angeles ever. It just doesn’t happen. And though we have to talk about this risk, as it is the main difference between owning a condo and owning a TIC, the risk is low.

WHY DEFAULT RISK IS LOW

We attribute this to the fact that there are only a handful of lenders who offer TIC loans, and they all have stricter requirements, like minimum 700 credit score, minimum 10% down, 6 months reserves seasoned in the bank account on top of the down-payment. This borrower is what many loan officers refer to as a “Grade A” borrower.

Everyone who buys TIC is vetted financially through one of the few TIC lenders, or is all-cash. This is who is co-owning the property with you; you end up owning a building with other co-owners much like yourself – co-owners who are financially responsible, financially stable, and who pay their bills on time. It’s not like buying into a condo, where your neighbor could have purchased their unit with low to no downpayment, sub-700 credit score, higher debt to income ratios.

Even TIC lenders have had extremely low foreclosure rates. NCB has only had two foreclosures, and Sterling has only had one foreclosure on their TIC loans in almost 2 decades since offering this loan product.

Venturing into something new always feels riskier. It’s important to know that even though this is a new market for us here in Los Angeles, it has been tested and proven in San Francisco for over 30 years. TIC HOAs even have lower arbitration and mediation than condo HOAs.

Why are TIC HOAs so successful? The two components we attribute to successful TIC HOAs are a good TIC Agreement and the lender vetting process. For these two reasons, we describe TIC as an elevated condo. The cost is less, but the product is the same, if not better.

TIC Has Rental Restrictions?

Can I rent out my TIC? This is a question that every single buyer asks. Every buyer we have sold TIC to date has been an owner-user, meaning they owner-occupied their TIC and did not purchase the unit to rent it out. The majority of buyers looking to purchase TIC are owner users, not investors. They want to buy TIC and live there. But, still, these buyers want to know what their restrictions are. What if they lose their job, or if their job relocates them, or they have a family emergency and need to leave LA? What if they travel for a few months? Can they rent out their unit? Every single buyer asks this question.

Why?

I have to address mindset here. The majority of TIC buyers are first-time homeowners, meaning they have been renting their entire adult lives. They are making the leap into homeownership, and taking that leap requires taking on more responsibilities and taking risks. When you have been renting for so long, you are living under conditions that have taught you to think and behave a certain way. These conditions are real and the only conditions you have known. You haven’t owned yet, so you don’t know what those conditions are like yet. You think you know, based on what you have observed, but you do not have the knowledge of something that comes from experience. What you know, as a renter, is flexibility. You can get up and go whenever you want. No one, no mortgage, is stopping you from packing up your bags and moving. You have this freedom. When this freedom becomes threatened, again and again (usually from a bad landlord who refuses to make repairs to your unit), it is easier to look at homeownership, which has less flexibility, as an option. Homeownership is something that is engrained in us from childhood that comes with age and responsibility. Like the children’s song: First comes love, then comes marriage. Then children, then homeownership.

Stepping into homeownership is letting go of the freedom and flexibility of being young. Rent control in Los Angeles makes this step even more difficult. If you are paying low rent due to rent control, once you become a homeowner you have to increase your housing expense which may require spending less on entertainment, eating out, and the like.

First-time homebuyers who are looking to buy, are normally at various states of this mindset shift. They have made the decision to purchase a home, and are at different stages of shedding these past beliefs.

“Can I rent my unit” is a question rooted in a past belief, originating from being a renter, that you need flexibility in your housing to have your freedom.

Even though you hate moving, you want to put down roots, and have likely lived in your current rental for years, you still believe that something may happen, that your life may change, and that you may need to move out of your home.

With homeownership comes the possibility of financial freedom through equity and appreciation. With homeownership, you build equity through time. The longer you own a home, the more chance you have to pay down your mortgage and to allow the home to appreciate in value. No doubt, the reason you are looking to buy and get out of renting, is that this concept makes sense to you.

But still, you want to know – what happens if I need to move? Can I rent out my unit?

PER THE TICA:

There are no rental restrictions inherent in the TIC Agreements of the communities we develop and sell. The TICA allows for renting, and is written to mimic a condo owner’s ability to rent.

PER THE PROPERTY TITLE:

With that said, there are often rental restrictions recorded on title that prevent owners from renting. If there is a title restriction, it is temporary (lasts for a certain number of years) and this restriction will almost always be at the infancy of a TIC development.

This possible title restriction has to do with a state law referred to as The Ellis Act. When a developer purchases an apartment building with the intent of converting it into condos or selling it as TIC, they must first relocate existing tenants. To do that, they have to remove the building from the rental market. There is a state law, referred to as The Ellis Act, that allows a property owner to exit the rental business. To do so, they must file the paperwork with the city, record a memorandum on title, pay all existing tenants a relocation fee, and allow them up to one year to move. If they go through this process, the city wants to make sure the developer and all future owners do not re-rent the units out right away at a higher rent, and abuse this state law to bypass rent control. The restriction requires that no units in the building be rented for a certain number of years. Simply explained, that duration is 5-years. Therefore, if a TIC building has been removed from the rental market, the city will prohibit you from renting your unit at all (including airbnb, roommates, etc.). No exchanging of rent monies until that time frame has expired.

PER THE CITY OF LA:

Furthermore, most TIC buildings are rent-controlled. Any property in Los Angeles built before 1978, that has two or more units on it, falls under rent control. In Los Angeles, you can rent a rent-controlled unit for whatever rent you want, but the city will restrict how much you can increase that tenant’s rent every year. You also cannot force a tenant to move at the end of their lease term. The tenant can stay as long as they abide by the lease terms, and their lease will default to month to month. This is a brief overview of LA rent control, refer to the city’s housing website for more information.

TICA + TITLE + CITY

What this means is, if the property was not removed from the rental market via The Ellis Act (no title restrictions), and there are no rental restrictions in the TICA, and the property does fall under rent control, then you can rent your TIC out for whatever rent you want. Your tenant would have protections, as outlined by the city’s rent control provisions.

If you are considering purchasing a TIC, and you want to know if there are rental restrictions, you have to ask the listing agent: 1) what are the rental restrictions in the TICA, 2) has the property been removed from the rental market via The Ellis Act (and if so, when did that happen, and when can you legally return the unit to the rental market), and 3) is the property rent-controlled?

THE FREQUENT MISUNDERSTANDINGS OF TIC.

What does a TIC owner actually own? We always scratch our heads when the first question realtors email us about a listing is “what is the ownership percentage of this TIC?” This question comes in many variations, and almost always originating from realtors (for whatever reason, buyers always “get” TIC faster than real estate professionals!): “What do I own?” “What percentage of ownership do I get?” “How does the property interest breakdown?” “Do I own the land?” “Does an entity own the property?” “Who is in control of the property?” “Do I share my equity?” “Who is in charge of the HOA?”

The reason this is an odd first question is because there is no value in title percentage. TIC value is in the exclusive rights and usage area. Andy Sirkin’s office has a great article explaining this. Click here to read it.

These questions are usually rooted in a misunderstanding of what TIC is, and how it is valued. It is understandable that mainly real estate professionals misunderstand TIC. It is human nature to compare something new with something you know. As real estate agents are more knowledgeable about sub-condo products, they tend to want to frame TIC around those alternative markets. It is easier for a buyer to put TIC in the “condo box,” because most buyers are familiar with condos, and they’re less likely to muddy TIC with other types of less-known markets.

When you purchase TIC, you are purchasing a fraction of the whole property and exclusive rights to one unit (and that unit’s outdoor space and parking). Therefore, when you buy TIC, you are buying two things: 1) a deed (Jane Smith has 25% undivided interest in Lot APN), and 2) a TIC Agreement (TICA) which is the legal document that gives you exclusive rights and usage to one unit, and if applicable, that unit’s private outdoor space and parking. Your usage rights are outlined in the TICA.

The TICA is like a condo’s CC&R and Rules and Regulations. It has a property survey which outlines the whole parcel and each unit’s measurements. It outlines in detail who has exclusive rights to which unit, and what those rights entail.

Can you renovate your unit? Yes, like a condo. Can you paint your front door purple? Not without HOA approval, like a condo. I’ve said it before: TIC appreciates like a condo. You buy it like a condo, sell it like a condo. What you can and cannot do, is like a condo. The TICA was written to create homeownership that mimics condo homeownership.

The TICA was written to create homeownership rights that mimic condo ownership rights.

When you buy TIC, you are buying a fraction of the whole property. There is no value in title percentage. You can own 1/100th of a 100 unit property. You can own 1/9th of a nine-unit property. You can own 25% of a fourplex, and have rights to the 500 square foot unit, and another owner has 25% title percentage with rights to the 1500 square foot unit. It does not matter what title percentage you have, you just need to have a deed with your name on it, and a good TICA that outlines your rights as a deed holder.

Still, some buyers get hung up on the title percentage. If you only own 25%, you must be missing out on something, right? What about the other 75%!? It does not feel right. That feeling should go away when TIC is explained and understood.

VOTING RIGHTS

There is more to understand about percentages. Like, each co-owner has equal voting rights. This is outlined in the TICA. So, the owner with 40% title percentage cannot control the group of owners with 20% ownership. Again, title percentage has no meaning or value. The TICA even limits voting rights further – if a co-owner owns more than one unit, that co-owner still only has one vote in the HOA. This prohibits a developer from keeping over 50% of the units and controlling the group. You will find that the TICA was written very fairly like this.

MAINTENANCE PERCENTAGES

Another thing to understand about percentages is how it affects maintenance responsibilities. Again there is no value or meaning in title percentage.

So what happens if the roof needs to be replaced (the roof is an HOA responsibility)? The TICA has a section regarding “Base Percentages.” In this section, the TICA contains a chart which outlines each owners base percentage. Base percentages are calculated using square footage. The larger 1500 square foot unit, for example, will have a higher percentage than the 700 square foot unit. When the roof needs to be replaced, the larger unit is responsible for a higher percentage of the bill than the smaller unit.

Certain HOA expenses are split equally, and some are split by base percentage. For example, insurance and common maintenance is split by base percentage. Finance manager and gardener’s fees are normally split equally. These expense categories will be outlined in the TICA.

As you learn about percentages and what all this actually means for you, as a TIC owner, you will begin to understand why we keep comparing TIC to condo. TIC is a lot like a condo.

If TIC is so much like a condo, why are we selling it as TIC, and not a condo?

Why can’t this just be a condo? If it was a condo, it would be 10-20% more expensive. So, that’s a good reason for you that it is a TIC, and not a condo. But I’ll address this question in depth, under “can I convert my TIC to condo?”

Can I convert my TIC to a condo?

This question always originates from a buyer who has done some preliminary research on the pros and cons of TIC. The TIC market started in San Francisco in the early ’80s, and there is now a whole lot of info about TIC on the web. If you do a quick search on TIC, you will come across articles addressing the pros and cons of TIC ownership. Some of the more popular articles mention the possibility of condo conversion. Once that information is fed to you, you now know it, and you are now going to want to know if you can convert your LA TIC into condos too. If you never read about condo conversion, this would not be a major consideration in your purchase.

People are buying TIC because it is more affordable than a condo, not because they may be able to convert it to condos in the future. Converting a TIC to a condo is like super charging your investment’s ability to increase in value. But TIC’s are a good investment as-is. TIC’s appreciate with the market. You are buying in at a discount, and down the road you will likely sell it a discount to comparable condos at that time, but your TIC value will have appreciated with the market.

The city of San Francisco has removed their lottery for condo conversions. The possibility of converting TIC-owned properties to condos is no longer a driving factor of TIC sales in San Francisco. The city of LA has heavy restrictions on condo conversions. The majority of properties we see being sold as TIC in LA will not qualify for condo conversions.

The first hurdle to converting an apartment building or TIC to condos is parking.

To convert a property to condos, the city of LA requires 1.5 parking spaces for each 1-bedroom unit, and 2.5 parking spaces for each two-bedroom unit. They did not start building apartment buildings with that much parking until the ’80s. Most condo conversions are 1980s (or later) apartment buildings. All our past TIC properties were built from the 1900s thru the 1950s. These older buildings are architecturally more interesting, have more land and outdoor space, and have smaller complexes. But, we’re lucky if they have one parking spot per unit. None of our past TIC properties would meet the parking requirements for condo conversion.

Many articles addressing pros and cons of TIC will list condo conversion as a pro of TIC ownership. However, we would argue that the #1 Pro of TIC Ownership is the ability to get out of renting and start building equity through homeownership. It is the number one feedback we get from current LA buyers visiting our TIC listings.

Do TIC’s appreciate with the market?

This is our favorite question, and probably the most important question. This is it. This is why buying real estate is so important. Building wealth through real estate is fundamental to our economy. When you buy a home, you’re buying a roof over your head. But more importantly, you are investing in your future. This is why we are so passionate about TIC sales. TIC offers more inventory at an affordable price, allowing more people to enter the real estate market.

We have only had a real TIC market in Los Angeles for three years. In those three years, we have sold over 140 TIC units. Almost half of those sales happened in 2020, last year. The market is too young to have resales yet. We have sold two resales since we started three years ago, both TIC owners sold after owning for one year. And both sold for 9% more than what they bought their units for.

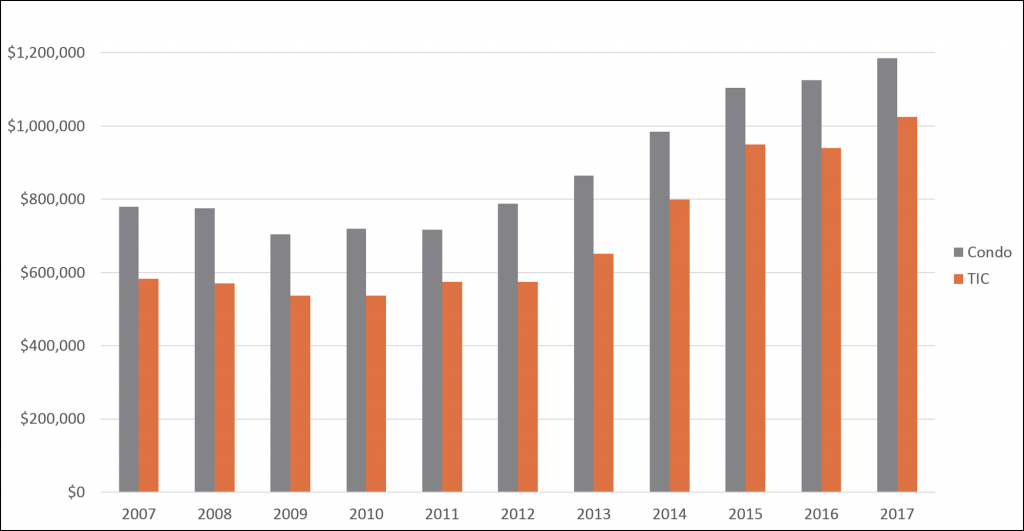

We do have a lot more data from San Francisco. They have been selling TIC for over 30 years up north. They even have a “TIC” category in their MLS. A couple of data analysts pulled the sales data from the San Fransisco MLS comparing TIC sales to condo sales from 2007-2017. The ten year period included the economic downturn. What they found was that TIC’s appreciate with the market. Most years, faster than condos.

These analysts displayed their results in a Medium.com article. This is our most referred article about TIC, and in our opinion, the most important.

As we can see from this graph, TIC prices appreciated slightly faster than condos between 2008 and 2017. Overall, TIC prices appreciate as much as, if not more than, condos. If you want your investment to appreciate, TICs clearly check the box.

Deniz Kahramaner

Who is the HOA, and what is included in the HOA dues? And, why aren’t the developers selling this as a condo?

What is the TIC HOA? A TIC HOA is like a condo. The organizational structure of the HOA mimics a condo HOA. Still, many people assume it is different. Their logic goes like this: if it’s so similar, it would be a condo! To understand the reason why developers are selling as TIC and not as a condo, read the above section “Can I convert my TIC to a condo?” To understand the function of an HOA in a TIC community, read on.

Who is the HOA? The HOA (homeowner’s association) is the co-owners of the property. If we are selling a 4-unit TIC, the four new owners are the HOA. Who is in control? As a TIC owner, you are! You and your other co-owners are in control. You are the decision-makers! There is no management company in control. The developer is not in control (the developer is out of the picture once the last unit sells).

Some people assume the developer retains some kind of ownership in the property or HOA – this is not true.

The TIC developer is no different than a condo conversion developer: developer buys an apartment building, relocates tenants, renovates the units, creates the CC&R’s (condo) or TICA (TIC), creates a condo map (condo) or survey (TIC), creates the budget study, and then sells the apartment units fractionally as a condo or TIC. The difference is the condo developer will subdivide the multi-family parcel into multiple condo parcels. The TIC developer does not subdivide the parcel – it remains a multi-family parcel. Once the last unit sells, the TIC developer, like the condo developer, is out of the picture.

Why are there HOA dues and what do the HOA dues cover?

Why are there HOA dues? In all TIC communities, there are common expenses. Even if the TIC community consists of detached homes, where every co-owner is 100% responsible for their own home, there are always common expenses. Most often, there is one sewer line, one water line, one insurance policy for the entire property, one gardener, and a finance manager (read about this below). The owners have to collectively ensure these bills get paid. For that reason, the co-owners have to collect monthly dues to cover these expenses.

How are the dues calculated? For our 2-4 unit HOAs, we generally do not include reserves. Reserves are monies for future common area maintenance expenses, such as replacing the roof, painting the exterior of the buildings, etc. For 2-4 unit HOAs, we look at this as a hybrid between owning a single-family home, and owning a condo in a large condo complex. In a single-family home, you are 100% responsible for all maintenance. In a large condo complex, you can vote who is on the board every year, and pay your monthly dues, and “check out” – let the board run the show. A 2-4 unit TIC is sort of a hybrid between these two types of ownership. The maintenance responsibility is not 100% on you, there is shared responsibility, but you can’t “check out” and expect someone else to do all the work. We have found that most TIC buyers are attracted to this type of ownership for this reason. In our 2-4 unit HOAs, the monthly dues are going to be enough to pay for the monthly expenses, and include a small buffer in case the monthly expenses run high (i.e. water leak, the gardener does extra work one month, etc.).

In our 5+ unit HOAs, we have a budget and reserve study done by a company licensed in the state of California to prepare budgets and reserve studies for condo HOAs. In 5+ unit HOAs, the HOA dues will include enough money to pay for the monthly expenses. In addition to that, a large chunk of your monthly dues will go towards reserves – a savings account for future maintenance expenses. This money is not for your individual unit expenses – you are responsible for the maintenance of everything within the walls of your unit. This money is for maintenance of all common area components – the roof, painting the exterior, etc.

Will the HOA dues go up? Are there existing reserves? Or, will there be an assessment soon? Most of our TIC listings are properties being sold fractionally as TIC for the first time. Meaning, the HOA is just forming.

2-4 UNIT HOAS

In our 2-4 unit TIC communities, the HOA dues listed in the MLS will be estimates. We base these estimates off of actual bills. However, certain bills, such as water, cannot be accurately predicted. Our monthly dues will be conservative and include a buffer, considering that water bills may be higher than the average. The dues could go up, if the owners in the building vote on increasing the dues for whatever reason they vote on (such as adding earthquake insurance, adding more reserves, etc.). It will be up to the new owners to discuss and vote on this.

5+ UNIT HOAS

As mentioned above, in our 5+ unit TIC communities we have a professional budget and reserve study performed prior to listing the units for sale for the first time. You do not need to be concerned the dues will be increased, or that an assessment is just around the corner. The “assessment” was just performed: how old is the roof? When does it need to be replaced? How much will it cost? Divide that cost by the amount of years left in the life of the roof, by 12 months, by the number of units in the building, add that amount to each unit’s HOA dues. This is the process the budget preparer goes through for each commonly maintained component in the property.

In summary:

The common expenses vary from property to property, and you can ask us at the showing what is included in that particular HOA. We also include this information on our online listings. Agents: we will always add a document to our MLS listings which includes the list of what is included in the HOA dues (see attached docs link below main thumbnail in MLS). Generally, HOA dues will include water, insurance, gardener, finance manager and in 5+ unit HOAs – reserves.

Who Manages the TIC HOA?

All HOAs have an option of being self–managed or professionally managed by a management company. If the HOA is professionally managed, the owners have to pay a fee for the management service. This fee would be added to the monthly HOA dues.

The management service is a third-party vendor who works on behalf of the HOA. The management company is responsible to all owners of the HOA, who are ultimately governed by the CC&R’s (for condos), and the TIC Agreement (for TIC). Therefore, when there is a management service in place, the professional management company is not “lording” over the group, or in control of the group. The TIC Agreement is the governing document for the group, and both the management company and the homeowners must ensure the TICA rules are followed. We are emphasizing this point, because so many buyers mistakenly think someone else is in control of the TIC HOA.

The TIC co-owners are exclusively the HOA, and together they are in control of their property. They can make decisions together on how they want to run their HOA.

All of our TIC communities to date are self-managed. They all have had 12 or less units in the community. Professional HOA management is too costly for smaller condo and TIC HOAs.

The feedback we got from the first few TIC communities we sold is that they enjoyed self-managing their HOA, but they felt they needed help with finances. For this reason, we now set up all our TIC HOAs with a finance manager. We have a few finance managers we found in San Francisco who handle TIC finance management. They are more reasonably priced than full property managers. They set up the HOA bank account and automatic ACH payments for HOA dues. They collect the dues, pay the bills, prepare a monthly cash flow statement, and help with the property tax bill breakdown.

The TICA outlines how the HOA should be run and operated. When we set up our TIC communities, we want to ensure the HOA is successful. We set up the HOA structure in advance, and help the owners initiate their HOA systems once all units have sold. Once the last unit in the building sells, our job is done. But we are invested in the TIC market and seeing it succeed here in Los Angeles. Ensuring these communities have successful HOAs is critical to the success of the TIC market as a whole.

My Story: Why I am Selling TIC in LA

From Liz McDonald, Broker and founder of The Rental Girl

In 2002, I came home from work to find a 60% rent increase on my door. I was 23 years old, living in a studio above a garage in Burbank, California. The notice lit a fire of anger in me. The root of the anger was fear – I lost control of my housing, and that scared me.

When I was in high school, I use to look at the Sunday real estate section in the LA Times. One Sunday morning, my dad saw me looking at beach homes for sale. He told me that if I wanted to buy a home like one of these, I had to start with buying something small. He explained to me that the longer I own property, the more it appreciates. After owning for a while, I could sell for more than I purchased for and then I could buy another home in a better location, or more homes as an investment. As a young adult, this was my first and only education about buying property. Like many other young people, buying and owning property is not something you learn about in school. It’s oftentimes not something parents talk about with their kids. The right to homeownership is so engrained in our culture, it’s often passed off as something that is just “there” and already known – the need to speak about, learn about it, and to understand its benefits is unfortunately overlooked. Those who do not have the benefit of having someone to guide them into homeownership often never look for the possibility or realize it is within reach. And with the current widening wealth gap, the possibility of homeownership is becoming barely reachable at all.

Back in 2002, I was being forced to move out of my rental and it left me with a bitter hatred for my landlord. I decided I would not let this happen to me again – I would try to buy a home. I’d had that conversation with my dad years back and it stuck with me. I would start small. I was already living in a small space. I figured I would buy a house and rent it out, and live in a converted garage studio.

I searched for months. This was before Zillow and Redfin and my agent had to fax me a list every weekend. I would drive-by over 50 properties each weekend. This was 2002 and it was a buyer’s market. Even so, I could not afford a home on my own. I recruited my brothers to buy an apartment building with me, and we ended up buying a building fractionally, as tenants in common (TIC). We found a building and we each moved into one of the units, where we still reside today with our families. When we closed escrow, my realtor asked us how we wanted to hold title, and went over our options with us. We held title as tenants-in-common, which protected each of our investments, allowing us to will our 1/3rd share to our heirs.

This event was so impactful for me, that I left my job and got into real estate. I mentored with a broker, a family friend who had his own property management company. I handled his leasing for him, and in 2004 I went off on my own and founded The Rental Girl.

I had a goal. I wanted to help other renters regain their power over their housing, just like I had done. But I never thought I could tell renters to buy a property fractionally with others, literally like I had done. I always considered myself lucky. Who else would have friends or family ready to buy at the same time? And then finding a property everyone was willing to buy – it seemed impossible. For the 15+ years I’ve been working with renters at The Rental Girl, getting renters into homeownership has been an uphill battle. Since 2004, I have heard the same story over and over:

“Housing is too expensive in LA, I’ll never be able to buy.”

But in 2016, things changed. I met Sterling Bank, and Sterling had the key to make fractional homeownership possible for renters much like myself. With a fractional loan being offered in LA, strangers could now buy a property together. Sterling Bank’s fractional loan product could change housing in LA.

When I met Sterling Bank, I did not realize they had been trying to push this market in LA for over a year, unsuccessfully. They had done multiple workshops and presentations to investors and though many were interested, no one was willing to test the market. My client was one of those investors. And when he presented the concept of TIC ownership to me, I instantly “got it.” I knew exactly what it was, I understood that the fractional loan was what would make a TIC market possible in LA. And I knew I could sell it. This loan product was the missing link to what I needed to fulfill my purpose – helping renters regain their power over their housing.

I also did not realize at the time that I would be a main player in pioneering a TIC market in LA, that The Rental Girl would be at the forefront of this movement. My client realized it, and wanted my help testing the market. At that point he didn’t even know that I owned a TIC, that this was how I got into real estate and why I started The Rental Girl. He just had the foresight that The Rental Girl had an inherent quality, a strong brand presence and reputation essential for encouraging early adopters and over-all market buy-in.

Even over the first year, after selling two TIC buildings, I still did not get the importance of my role. I pushed TIC on every realtor who would listen to me. I created a “TIC Bible” with a checklist on how to sell TIC. I thought, if I can do it, they can too. What I didn’t realize is that my checklist was ever evolving. After selling over 50 units in 2 years, the lessons I was learning with each transaction were contributing to an incredibly fast learning curve, improving my ability to sell and explain TIC, improving my processes, improving the HOA structure, and improving my systems and our communities. It wasn’t until I started to see other agents fail that I realized the importance I have and the value I bring in selling TIC.

Together with my partner Cristina, we have created a TIC Team at The Rental Girl. Through this process, we have become TIC consultants for investors and landlords. We are helping develop future TIC communities. We help the developer with project analysis and execution. We oversee the scope of work and design on all our projects. We are TIC listing agents selling TIC communities to co-owners, most of whom were previously renting. We have had a high quantity of listings, we’ve made mistakes and are learning from them. Because of this fast learning curve and the constant improvements we are making to our process and to our communities, we now have a policy of only selling TIC listings in communities we have consulted the developer on from the beginning. We will not take over another project if other units have sold and we will not sell a project that has been developed without our oversight and input. We want to make sure we can stand behind the communities we are selling. You can read more about our Gold Standard, here.

We not only take pride in the communities we’ve developed, we take ownership in their success. The success of each community is critical for the overall success of the TIC market in LA. We’re not just trying to sell a unit, we’re selling a market, a new market. We’re selling a concept, a new concept. Each community we sell is depending on us. And that is something we do not take lightly.

After years of helping landlords rent their properties, and renters rent them, why am I now turning my focus on TIC sales? The Rental Girl leasing team is still very much going strong. You can still depend on us as you have since 2004 on finding quality rentals. But, with the help of my TIC Team, I am personally focused on growing the TIC market in LA. Why? Because our economy needs it, desperately.

From the beginning, I knew rent control was not a sustainable solution to affordable housing. I recognized it was a band-aid, aiding those in need in the immediate moment. But for long term economical health, more sustainable housing solutions would be needed. Not just one solution, not a one-size-fits-all solution rent control is made out to be, but multiple solutions to encompass all economic backgrounds. And not band-aids to cover up the symptoms of deeper problems, but solutions that attack the roots of the economic malfunctions of our economy, and future-thinking solutions that can begin to change our future for the better.

A problem with our housing situation has been supply and demand. The problem with the supply part is that government funded housing does not work, and there have been little incentives for developers to build affordable and mid-range rentals or homes. Demand keeps increasing, but with no economical incentive for encouraging construction of affordable and mid-level housing, the demand is not being met. If investors aren’t making money, they will invest their money elsewhere. Now, I know what most of you are thinking. It seems to be human nature to loathe other people making money when we aren’t. Knowing that others are making money off our housing just does not sit well for most of us. But the reality is, we have not been able to rely solely on our government for housing. The reality is, we need investors developing housing, and they require a profit.

One potential solution to our housing issues is working with our local government to create opportunities and incentives for developers to develop low-income and mid-income housing.

We can continue fighting for rent control, but rent control does little to help the future of renters. We need to also fight for a better future. Rent control is a necessary band-aid. But once in a rent control unit, what’s next?

We need to create more housing, and not just low-income and luxury housing, we must also create mid-income level housing. And we need to create opportunities to get renters out of their rentals, and into homeownership.

Aren’t TIC’s removing rent controlled units from the rental market, and displacing existing tenants?

Some argue that the downside of TIC sales are that they are removing rent controlled apartments from the rental market. And that renters are being relocated in order for the units to be sold. They will argue that this will add more burdens to our housing crises, and that it is unfair to remove a tenant from their home.

But that is just the point. It’s a lesson I learned when I was 23. We do not have power over our housing when we are renting. We cannot depend on rentals as our permanent housing solution. Renting will always be the only options for some, no matter what the economic status is, as not everyone is always looking to move into a home they will live in forever. Also, not everyone can afford to buy. But we have to stop accepting this reason – that renting is the only option because renters cannot afford to buy. This is a symptom of a systemic economic failure, and this is the change we need to fight for. However, our fight for renters has been singularly focused, with more and more intensity, on preserving and strengthening rent control.

With rent control going on 40 years in LA, the entitlement to one’s rent is just as engrained in our culture as the American Dream of owning once was. We must continue fighting for the right to homeownership, with the same fervor and passion as we are fighting for fixed rent, and affordable rental housing. Why have we stopped? Because we don’t believe it is possible. And if it’s not possible, then we are forced to hold on to what we have – rent controlled units. But this is not a future-thinking solution. This is not a systemic approach to creating a healthy housing economy. We must also continue dreaming up possibilities of homeownership, creating new opportunities to get renters into homeownership.

In the past 2 years, I have been interviewed for media stories 12 times. And each time, the story is the same: a short explanation of what TIC is, who is benefiting from it, and who is not. To sell an apartment building fractionally, to multiple co-owners, the previous occupants are relocated. There is a state law that allows landlords to remove their rental units from the rental market which often has to happen to sell TIC to buyers who plan to owner occupy the unit. The problem with the past press is that these articles have not gotten to the heart of the issue.

To be told you have to move out of your home, no matter how much the monetary relocation fee is, is not easy. When it happened to me, and I was not poor, elderly or disabled, it was the most angry I have ever been. The heart of the issue is that rent control has given us a false sense of security over our housing. But renting is not safe, and has never been. It is not a viable and permanent solution to housing low-income, elderly, and disabled. Because we have been so vocal and adamant about rent control, local politicians have used it as a red herring, putting rent control at the forefront of affordable housing and diverting much needed attention, resources and energy to developing and creating alternative sustainable solutions for those in our community in need. We cannot continue to allow members of our community to grow to be 90-years old, living on life-support, and to have gotten through life with absolutely no other options, no place else to go other than a rent controlled unit. We need more solutions.

My plea to renters is to stop relying on rent control as the only solution to affordable housing. Rent control is a one-size-fits-all and only solution to affordability and has not helped improve our housing situation, which has been getting worse every year since I have been working as a rental broker. It may be the only safety net our city, government, and community has afforded you, but things have to change. And I am not saying we need to get rid of rent control, as that would have equally devastating results, but we have to stop pushing all our attention on it. We need to divert some energy and resources to future housing solutions that are more sustainable.

I have found TIC ownership to be one such solution, and am fighting for it. But there are many of you out there, and many other solutions to be discovered and explored.

What solutions will you find and fight for?

The Rental Girl TIC Team