Deniz Kahramaner used to lead data projects at LinkedIn Recruiter and Accompany. He and Jeremie Young started a data initiative, helping real estate buyers, and sellers make important decisions using data. We are reposting their article from Medium.com which was a part of that initiative.

Here at The Rental Girl, we have read a lot of articles about Tenants-in-common (TIC), and this one does a great job presenting the pro’s and con’s. The authors pull data from 10 years of TIC sales in San Francisco and lay out the information in easy-to-read charts and graphs.

Click here to read the full article.

We have read the article, and for the most part the pro’s and con’s are applicable to Los Angeles TIC sales as well, with a few exceptions.

- MYTH: condo conversions are the main benefit of TICs.

The city of San Francisco has removed their lottery for condo conversions, so the possibility of converting TIC-owned properties to condos is no longer a driving factor. The city of LA has heavy restrictions on condo conversions. The majority of properties we see being sold as TIC in LA will not qualify for condo conversions.

The author lists the potential to convert tocondos as the #1Pro of TIC Ownership. However, we would argue that the #1Pro of TIC Ownership is the ability to get out ofrenting, and start building equity through homeownership. This is a point the author did not make at all, and it’s the number one feedback we are getting from current LA buyers visiting our TIC listings.

As a side note, in our experience the #2 Pro of TIC Ownership is community and co-ownership. Buyers are drawn to TIC for affordability and for sense of community, which is not often found in larger condo complexes. - MYTH: Fractional loans have

higher interest rate.

Sterling Bank TIC loans are at 3.625% (as of January 2020). Definitely comparable to going rates! - MYTH: Fractional loans require higher down-payment and have a higher monthly payment

. Sterling Bank requires a minimum of 10% down. Not bad! The monthly payments withprinciple , interest, property taxes, insurance (PITA) and HOA dues of our past TICs have been equal or less to what the market rent would be. Would this be a higher monthly payment than a condo, as the authors suggest? I have not seen a condo in recent years where you can put 10% down, and have a monthly PITI and condo dues equal to market rent. TIC mortgages are affordable, and that is the appeal. - MYTH: TICs have legal complexities — many of them.

This is not so much a myth as it is misleading. Condos have legal complexities. Buying real estate has legal complexities. Renting can have legal complexities. While there are MORE legal complexities with TIC’s than renting, there are not necessarily more than owning a condo. TIC is just a NEW concept. And with any new concept there is fear of unknowns until the market has been tested. Even though the market has been around for 30 years in San Francisco, it is a relatively new market. The market did not take off in San Francisco until the mid-90’s.

The rest of the article is

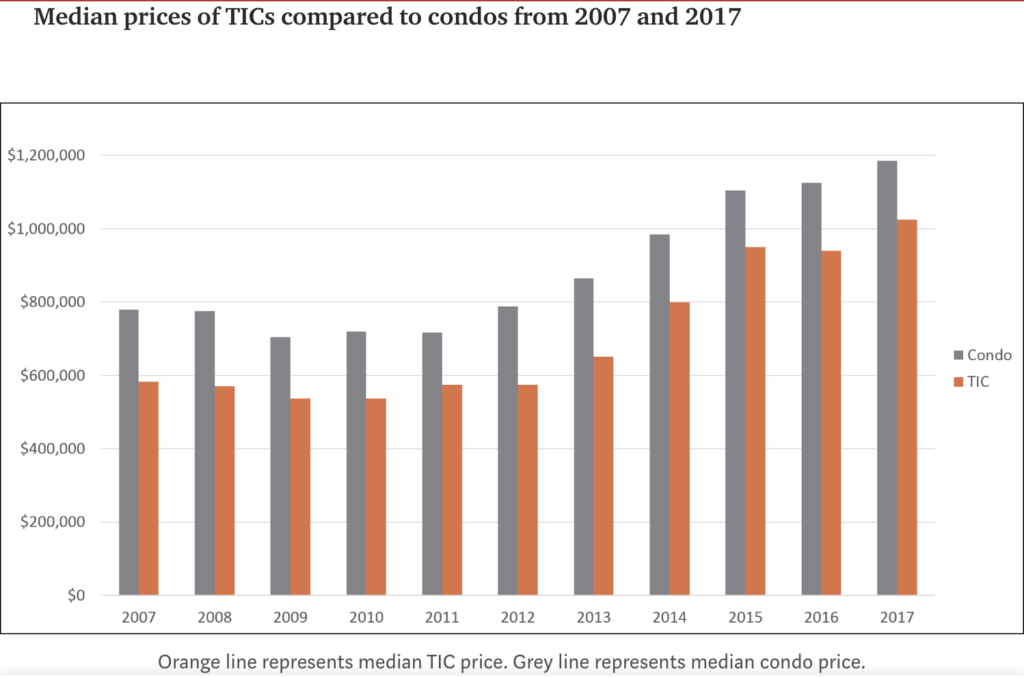

Please refer to a few charts from the article:

Median prices of TICs compared to condos from 2007 and 2017:

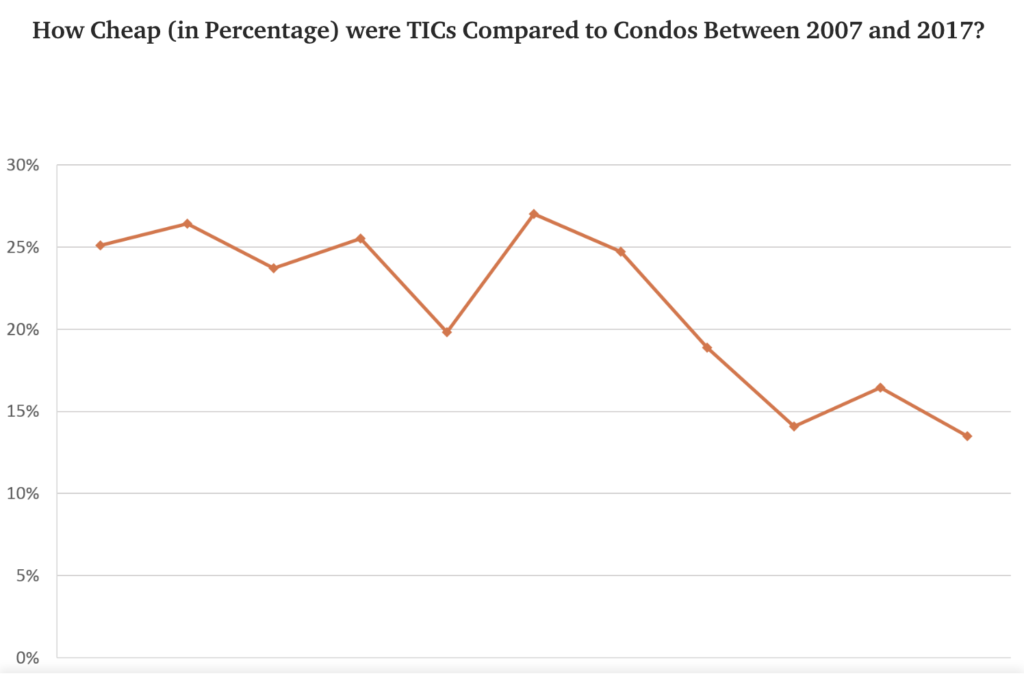

How Cheap (in Percentage) were TICs Compared to Condos Between 2007 and 2017?

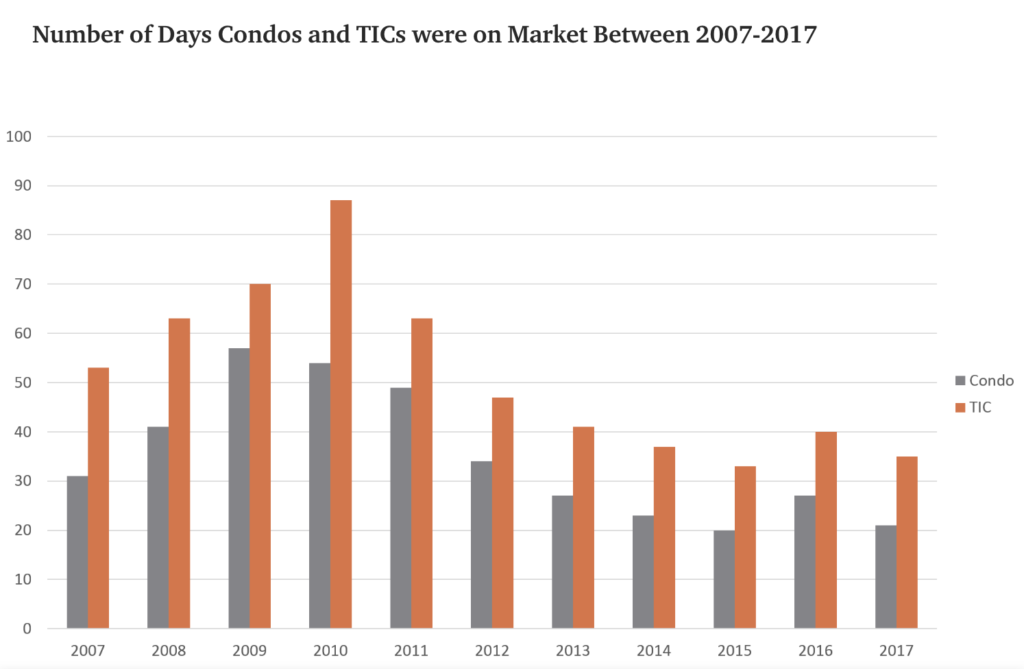

Number of Days Condos and TICs were on Market Between 2007-2017:

Let us know your thoughts after reading the article!