KCRW reporter, Anna Scotts interviews Liz McDonald, founder, and broker at The Rental Girl, on her thoughts and hopes for this up and coming market.

” A New Model For Living In LA”

-Press Play With Madeleine Brand

To listen and read the entire interview + learn a bit more about Tenants In Common, check out KCRW’s Press Play with Madeleine Brand; To keep prices down, some LA home buyers are sharing costs. But renters may pay a price

The Rental Girl was featured on KCRW this past week to discuss the growing popularity of Tenants-In-Common (TIC) sales here in Los Angeles.

TIC sales are hugely popular up in San Francisco, and we are starting to see more of them here in LA.

What’s the big deal about TIC? With TIC, you’re buying a fraction of an apartment building, with exclusive rights to live in one of the units. TIC sales tend to be 10-15% less than comparable condos. As the cost of homeownership increases, TICs are proving to be not just an affordable option, but in many cases the only current option for renters to get into homeownership.

The Rental Girl has sold dozens of TIC units in the last year. The majority of

these buyers were previously renting, and TIC was their opportunity to get into

LA real estate. And this is why we’re so passionate about TIC sales. We see TIC

sales as an opportunity to get our renters into homeownership.

You may be wondering what about the downside of a TIC market? Aren’t TIC sales removing rent-controlled units from the LA rental market? Yes, this is true. But we would like to offer you a different perspective on this issue.

You can view the removal of rent-controlled units from the market as a problem.

Housing is expensive and we need affordable options, right? The Rental Girl has

been in the rental market for 18 years, and we agree: we see the affordability problem.

But we also see a different solution than what’s generally discussed. When you

hear about rising housing costs, the first solution we gravitate towards is “we

need more rent-controlled units!” But are rent controlled units really

providing a solution?

According to the Census Bureau, there are 4 million people in LA city. We have 1.5 million housing units in LA. 953,000 of our housing units are rentals. 2,525,000 are renters. This is a lot of renters!

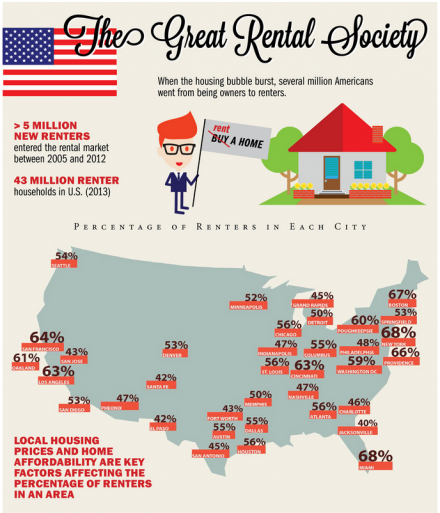

63% of us are renting. Who are these renters, the majority of Angelinos? Are they like you? Are they like me? Where do they live? What do they like to do? Where do they work? What is their income level? Are they single, married, do they have kids? Pets? There are 2 ½ million renters. They are the majority of us, and they are as diverse as our city.

According to the Census Bureau, the average income in LA is $50-$75k. Some renters are making 15k/year, some are making 200k/year. Some renters just need a bed and a roof over their heads, some renters need a room to fit their king size beds. Some renters want outdoor space, some want a walkable neighborhood. Some renters want washer/dryer in their unit, some will be happy if the unit comes with a fridge. Some renters want their landlord to provide blinds, some want to bring their own curtains and decorate to their taste. Some renters want to be able to paint the walls, some don’t care. Some renters need a parking spot with electrical charging station. Some renters don’t have cars. Some renters want a space with a minimum square footage, to be able to choose their amenities, their neighborhood, their neighbors. Some renters will settle for what is available.

It doesn’t matter who you are, what your needs are, what you can afford. If you’re paying $500/month or $5,000/month we all will agree on one thing: the rent in LA is “too damn high.” There isn’t a renter in LA who hasn’t complained about the cost of living in Los Angeles.

Because of this, renters are often spoken about and referred to as one unified group. When we hear “renters rights” we assume these presumed rights are the best for all 2 ½ million renters. And when we talk about rent controlled units, we assume these are also best for all renters.

We know this is not true. And we know that not all renters would benefit from universal rent control, because not all renters want universal rentals. When we cap rent, we cap potential profits landlords can make, and we limit those who can invest in real estate. Mom and pop landlords will be squeezed out the industry. Corporations and those with deeper pockets will move in. With fixed rents, there will be less incentive to maintain and fix up properties. Why update the counter tops and appliances? By fighting to keep rents low, we inadvertently give up our freedom of choice.

This may not be a concern for you, if you currently don’t have a choice: you are stuck renting where and what you can afford. And you may feel that all renters are in the same place as you right now. But the majority of renters who can afford choice – they just don’t like that they have to pay for it – these renters will be giving up their freedom to choose where and what they want to rent.

Whether we fight for universal rent control in the future or not, the fact remains that currently only multi-unit properties built before 1978 are rent controlled. And there are legal reasons to remove those units from the rental market, and there are ways for property owners to reclaim their units.

The idea that your rent amount is fixed, that you’re entitled to pay a fixed rate forever, just because rents are increasing and affordable housing is hard to find… is a myth.

Your rent is not protected. After your lease term is up, you no longer have a “right” to live there. It is a privilege, it is not a right. You are renting, you do not own.

As our society pushes more and more for this right, we are inadvertently pushing the middle class out of home ownership. Rent control also creates a sense of false security to middle class renters. Why buy when your rent is so low? Fixing rents reduces investment property ownership appeal to all those except those with deeper pockets. We have seen this happening over the past few years as more and more corporate owners enter the LA landlording business.

The bigger picture is that homeownership becomes less and less reachable to you and I. The fact that there are renters making 50-75k a year, living in rent-controlled apartments, and not able to buy in LA – this is the problem.

With TIC sales, we’re taking apartments and selling them. Who is buying these units? It’s almost impossible for entry level buyers to buy single family homes in LA. It’s the middle-income earners who are currently renting – these are TIC buyers. TIC sales are removing rent-controlled units from the market. But they are also removing rent-controlled renters from the rental market as well. And yes, this is only a crack in the housing crisis. It’s not a one-size fits all solution, as rent control tries to be. It’s actually a healthier solution because it’s a holistic approach to fixing a systemic problem, not just putting a band-aid on the problem as rent control does. And as with all problems, the best way to tackle them is by taking small steps.

You can fight for your right to fixed rent. Or you can fight for your right to be a homeowner. Here at The Rental Girl, we’re fighting for the latter.