BACKGROUND: WHAT IS THE LAHCID?

Any property in Los Angeles that was built before 1978, that has 2 or more units (attached or detached) on one lot, falls under LA rent control jurisdiction. We refer to these buildings and units as “rent-controlled.” This department was previously called the “Los Angeles Housing Department,” or LAHD, for a long time. In the past few years, they changed their name to the “Los Angeles Housing and Community Investment Department,” or LAHCID for short. You may also hear people referring to this department as RSO (rent stabilization organization). This is the city department that oversees all rent-controlled units in Los Angeles.

WHY ARE YOU GETTING A BILL

The LAHCID charges a yearly RSO fee to all landlords who have rent-controlled units. They charge a flat fee per rented unit. If you are an owner in LA with a rental unit (that is rented and that falls under RSO jurisdiction), you have to pay a yearly fee to the city for the right to rent your unit out. You can file for an exemption for any units in the building that are not rented, and then you would not have to pay the fee for those non-rented units. These are called exemptions.

HOW THE BILL WORKS

The RSO fees are due yearly. The city sends one bill per parcel/property. Your “unit” is not a parcel. The parcel is the entire community, all units on the parcel. Remember, as TIC owners, you own a fraction of the entire parcel.

WHO THE BILL GETS MAILED TO

The bill is only addressed to one human being. That is because they cannot physically add multiple names to the bill – there is not enough space to do so. Also, see the note below regarding “Who’s name is on record?”

WHERE THE BILL GETS MAILED

Because there is one bill for all units on the parcel, the bill can only be mailed to one address. Until you ask the housing department to update their records, the city uses the owner’s mailing address from the last recorded deed on title. If you have updated the owner’s address with the housing department already, but then another unit sells in the community, the new sale will override your record and the new owner’s name and mailing address will automatically be updated as the owner on record.

WHO’S NAME IS ON RECORD?

When a TIC “unit,” or fractional sale closes escrow, the housing department updates their records. They assume the sale was a typical sale, deeding 100% of the property to a new landlord/owner. Therefore, they delete the last owner’s name on record, and they replace it with the new owner. The RSO software doesn’t read the actual deed. If they did, they would see it was a fractional sale and therefore should not delete the past names on record. But they do not. This is frustrating, but c’est la vie! I will explain how to deal with this below.

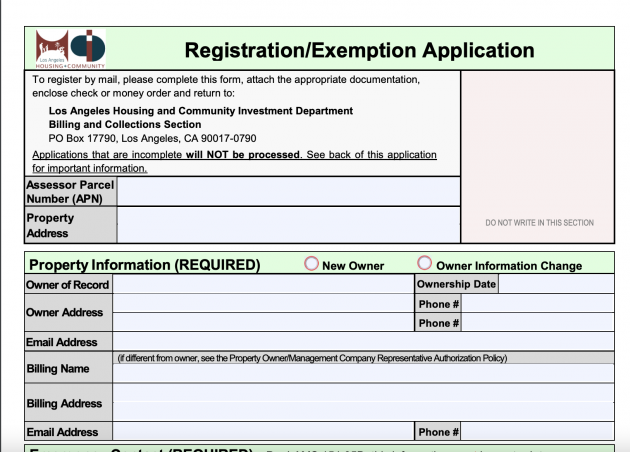

HOW YOU SHOULD HANDLE THESE BILLS

Your HOA president should oversee the registration, exemption and/or payment of these bills each year. At the close of each sale, the city will assume it is a new owner, and will mail a new bill to the latest TIC owner. The HOA will have to reply to the bill (either file for exemptions, and/or pay the bill), and update the ownership information to include all the owners names on title. To do this, you have to include a copy of all deeds on title as proof of ownership. You will have to go through this process multiple times until the last unit sells. After the last sale, you will only receive a yearly bill. And each time you get this bill (once a year) you will have to file the exemption (or pay the fee if one or more units in the building is rented).

Once the last unit in the community sells, you should register your building online with the housing department. When you do this, you can file exemptions for each unit that is not being rented. We have created detailed instructions on how to do this. You can download our instructions here.

It is important to let each owner in the TIC community know that if they receive a bill from housing, it may have their name on it, but it is NOT their responsibility 100% to fill it out. It is the HOA responsibility. They should immediately turn the bill over to the HOA president, and the HOA president should address the bill – either updating the owner information, filing for exemptions, or ensuring the bill gets paid (payment is only needed if the property was not Ellis’d, and if one or more units are rented).

**Note: If your property still has a seller-owner unit that is either tenant-occupied or vacant, please contact us and we will have the seller register the exemptions for the group.**

A NOTE ABOUT LAHCID PROPERTY INSPECTIONS

The city does inspections of the interiors of every single rent-controlled unit, that is tenant occupied, every 3-5 years or so. They send a letter in the mail notifying you (the property owner) when they will be by the property. If you have a rented unit in the building, they will need to see the interior of that unit. You would have to notify the tenant that the city inspector is coming in. If you are a landlord with a tenant in a rent-controlled unit, you have to allow the city inspector access to your tenant-occupied unit.

If you owner-occupy your unit, or you are NOT renting it out (ie, your daughter or brother is living in the unit), you do NOT need to pay RSO fees, and you do NOT need to let LAHCID inspectors inside your unit. The city inspector may show up to your door, not realizing it is not rented, and they may try to enter. You do not need to let them in. It sometimes takes the city time to update their records. You may have sent in your exemption form or filed it online. But these records don’t often make it to the inspector’s desk. If they show up, do not let them into your unit. You may have to argue with the inspe tor, but there is no legal reason the housing inspector needs to enter your home, unless you are renting the unit to a tenant.

If your property was removed from the rental market via the Ellis Act, it should be removed from LAHCID system altogether. However, the Ellis department takes a long time to update the housing department’s system. So, it may take a few years for the housing system to be updated. In fact, they may never update it. In the three years we have been selling TIC, they have not updated their system. Therefore, you have to continue to file exemptions each year, exempting your building from the RSO.

If your units are owner-occupied, and/or not rented, as long as you file the exemptions each year you will not owe RSO fees.

EXEMPTION AND CHANGE OF OWNERSHIP INSTRUCTIONS

Click on the link in the green box below for full instructions.

Here is the overview: