Thousands of people flock to the City of Angels every year, but the housing stock market is struggling to keep up with the rapid pace of newcomers. As a result, rent prices are skyrocketing in desirable markets like Los Angeles–which is proving troublesome to even middle-class residents.

Our friends at Zillow recently released data on the rise in rent prices, and the pressure that that’s placing on the middle class. The results are interesting, yet alarming:

- In Los Angeles, rents rose nearly 4.9 percent from January 2014 to January 2015.

- Los Angeles renters spend 48.2 percent of their income on rent each month, assuming the median income. Homeowners pay 40.1 percent of their monthly income on mortgages.

- LA permitted just 187 new units for every 1,000 new residents from 2012 to 2013, according to Zillow.

Due to the increased unaffordability, many middle-class residents are asking themselves the time old question: To Rent or To Buy? The Breakeven Horizon shows that renters should consider buying in LA if they plan to live in a given area for 5.1 or more years. In other words, you would have to live in your home for 5+ years to save money on the accumulating costs of buying rather than renting.

Evidently, as shown in Zillow‘s data above, there are too many people and not enough places to live in Los Angeles. With 1,000 newcomers in 2012-2013 alone, new housing units aren’t even meeting 20% of that resident increase. Mayors in other high-population growth cities like San Francisco, New York and Boston are implementing major new housing plans over the next 10 years to address this issue. Let’s hope Los Angeles is next!

Happy Hunting!

The Rental Girl

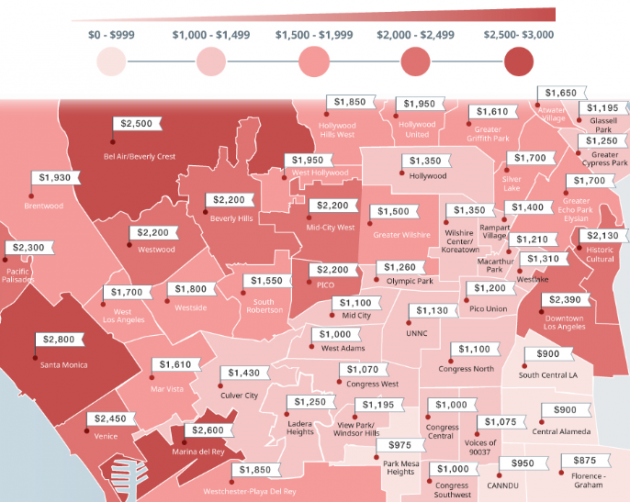

Cover photo: Zumper LA Rent Heat Map

City Skyline photo: World Property Journal